According to the National Credit Regulator, nearly 25 million people in South Africa are in debt, and 40% of them are behind on their repayments. This is a staggering number.

From payday loans and credit cards to overdraft and store clothing accounts, debt has become a vicious cycle for many.

How does one get out of debt? By putting a plan in place. Although this sounds easy, many people just don’t do it.

Let’s be frank – money is an emotional topic for the majority of people, as debt often comes with the emotions of anxiety, shame and helplessness.

To begin your debt-free journey, here are some steps you can take:

KNOW HOW MUCH DEBT YOU HAVE

Because most people tend to get overwhelmed, they ignore their finances in the hope that, somehow, the debt will just go away by itself.

This is the ostrich mentality – at the sight of danger, the ostrich sticks its head in the sand and hopes that the danger will have passed when it brings its head out again.

Unfortunately for the ostrich, it is not aware that it is still fully exposed and is visible to its enemy. Unfortunately, when it comes to money, this kind of behaviour will only get you into deeper trouble.

You need to make a list of all your debts and know exactly how much and who you owe. You can only change what you face head-on.

From here, you can chose which method you will use to pay off your debt.

PAY OFF THE DEBT WITH THE HIGHEST INTEREST FIRST

I often do workshops where I ask people if they know the interest rate they are paying on the different debts they carry and, 90% of the time, the resounding answer is no.

This is brought about by our fixation on the final amount we pay. For example, when buying a car, many people don’t look at how the dealer got to the final instalment amount, just as long as it seems to fit within their range of affordability.

Knowing what interest rate is charged on your debt is effectively knowing what the debt is really costing you. The debt with the highest interest rate is the debt that is the most expensive – it doesn’t matter what the outstanding balance is.

If you were to use the method of paying off the debt with the highest interest first, the first debt you will tackle will be your overdraft, followed by your personal loan, your credit card then the store clothing account.

This means that you will focus your efforts and put any extra money towards the debt that is costing you the most.

Read: 4 ways to pay off your debts – lessons from our Money Makeover contestants

THE SNOWBALL METHOD

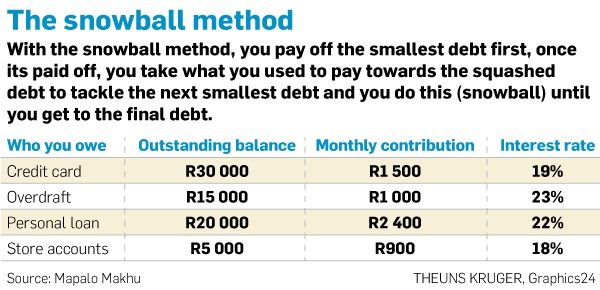

With the snowball method, you completely pay off the smallest debt first. Once it’s paid off, you take what you used to pay into the now squashed debt to tackle the next smallest debt.

You continue to do this until you get to the final debt.

While the first method makes financial sense, the snowball method is more psychologically rewarding because of the immense satisfaction that comes with sticking to a plan and seeing it through.

A person is less likely to be overwhelmed when motivated – it is all about the small wins in the snowball method.

If you used the snowball method, the first debt you would work towards paying off would be the store account as it has the smallest outstanding balance.

After paying it off, you will move on and pay off the overdraft by increasing your monthly contribution by the amount you have just freed up by squashing the store account.

You continue this way until the highest outstanding balance is paid off.

Paying off debt isn’t easy, but the benefits are worth it.

Sadly, most people hope for a windfall of money instead of crafting a plan to get out of debt, and even if they do get this windfall, either in the form of a bonus or, worse, by cashing out their pension fund, they quickly find themselves back in the same indebted situation.

This is because they addressed the wound and not the source of the problem. Paying off debt is not just about the debt itself, it’s about recognising your behaviour towards money and changing your habits.

At the end of the day, choose a method that you will follow through with – and stay out of debt.

Makhu is a financial coach

Publications

Publications

Partners

Partners