The recent dismal performance from the JSE saw South African investors increasing their allocation to low-risk, fixed-income funds.

According to investment research firm Morningstar, more than half of the money that flowed into investment funds last year went to fixed income.

Nearly R30 billion went into interest-bearing short-term funds as investors sought refuge after a dismal 2018, which saw the market lose 8.5%. Yet, at the time of writing, the JSE All Share Index was up just over 8% since the beginning of the year. While not quite at the peak it hit early last year, it is not far off.

Those investors who panicked and sold out when the market fell to its lowest point in October locked in their losses and then lost out on the recovery.

Many of these investors ignored fund managers, who, over the past few months, have been arguing that the South African market offers more value now than in the past 10 years. Investec Asset Management is the most bullish – predicting the market will return 15% a year for the next five years.

While that will not be in a neat, straight line, it does suggest that investors would effectively double their money over the next five years.

Old Mutual Investment Group is predicting 5.5% above inflation – at an inflation rate of 5%, that would be a return of just over 10% a year. PSG Wealth believes that many of South Africa’s household names are trading well below their long-term price-to-book ratio, which includes industrial and financial shares.

Many of these large institutional investors are starting to buy up local equities, which is, in part, driving up share prices. The good news is that, as these are local investors, they tend to be more sustainable than the short-term buying and selling that is typical of foreign investors. This suggests that the JSE has some long-term buying support.

So, what should you as an investor be doing? What you shouldn’t be doing is attempting to time the market. Research by Morningstar shows that, by trying to time the market, investors invariably end up worse off than if they stayed invested.

If you had invested R100 000 in the market in January 2007 (using the JSE All Share Index for return purposes) and remained invested right through the global market crash in 2008 until December last year, your investment would be worth R300 353. In other words, your money would have trebled despite the worst financial crisis in nearly 100 years.

If you had withdrawn the funds after the crash and then reinvested a year later, your return would be only R219 629. If you had left your money in cash after the crash, it would only be worth R148 282.

Trying to time the market by only investing when the recovery is well under way guarantees that you will miss out on some of the best returns because stock markets don’t go up in a straight line – most of the returns in a year are made in just a few good trading days.

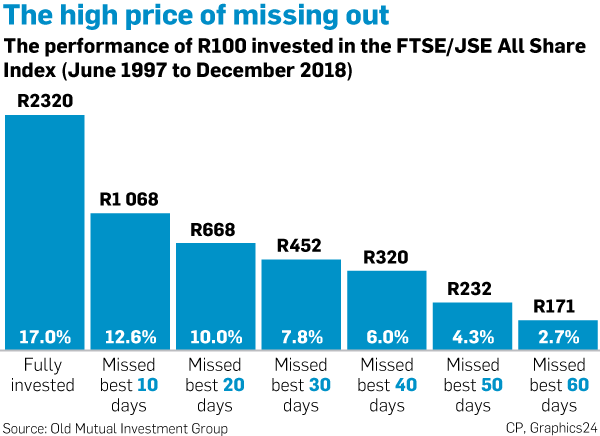

Old Mutual calculated the difference it made if you missed out some of the best trading days between June 1997 and December. If you had invested in June 1997 and remained invested, you would have had an annual return of 17%. If you missed just 10 of the best trading days out of 3 780 days, your return fell to 12.6% and if you missed the best 40 trading days, your return fell to just 6% a year – so you would hardly beat cash.

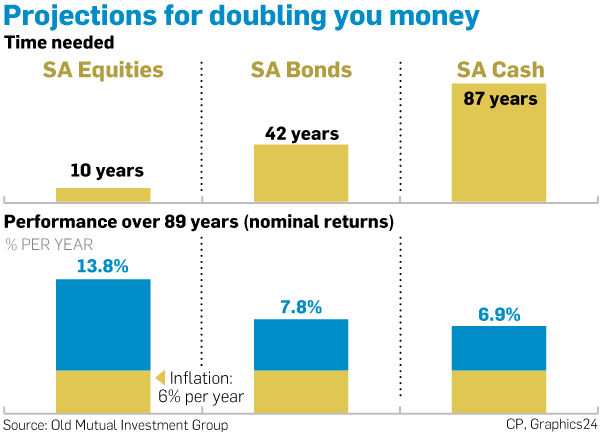

Old Mutual argues that, based on the returns over the past 89 years, equities remain the best provider of long-term returns.

Over that period, the long-term average of the South African equity market has been 13.8% a year, South African bonds 7.8% a year and South African cash 6.9%. In comparison, inflation has been 6%, which means cash barely beat inflation, while equities provided a return more than double inflation.

If you are saving towards retirement over 15 to 40 years, a high equity exposure is a necessity to keep ahead of inflation. But if you are investing for the short-term – less than five years – then equities do become risky.

Based on research conducted by Old Mutual and Morningstar, the probability of negative returns from the equity market over one day is 44% – that means if you only invest for a day, there is a very high chance you may lose money.

However, over a year, that probability falls to 20%. By three years, the chance of your investment being less than you invested drops to 6% and over a five-year period, the probability is zero. In other words, at no point in the JSE’s history has anyone lost money in the market if they remained invested for five years, which is why equities are considered for longer-term investing.

WHERE TO INVEST?

While fund managers are more positive on South African equities due to improved valuations, any long-term investment portfolio should have offshore exposure. While South African equities have actually outperformed global equities on average over the past 94 years, this is because South Africa has a higher risk rating. The higher the risk, the higher the return should be to compensate.

A diversified portfolio with offshore exposure would lower the risk of your investment. According to Old Mutual, “investing globally remains a powerful source of diversification and risk reduction”.

If you are looking to invest with some diversification, most multi-asset, high-equity unit trust funds have both local and offshore exposure, as well as exposure to listed property, bonds and cash. Alternatively, you can invest in exchange-traded funds, but split your investments between a local and a global index.

Keep in mind that the best returns are delivered if you leave your investment to grow. It is a lot like baking a cake – if you keep opening the oven to check on it, your cake is going to flop.

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners