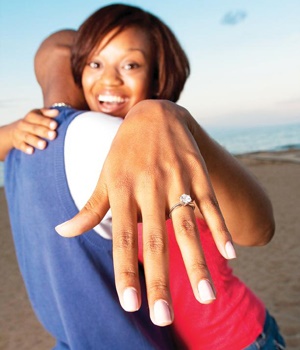

It’s Valentine’s Day and it is also a leap year, so more than a few couples will probably be considering getting engaged in 2016. Before you take that leap, consider the effect that different types of marriage contracts will have on your finances. Neesa Moodley reports

When we get married, we are certainly not thinking about what will happen if the marriage does not work out – that would be far too depressing and this is meant to be a day of rejoicing.

Yet it is important to understand that a marriage is not just about standing before family and friends to declare your love. Marriage is actually a contract that you enter into, and it has implications on all aspects of your finances.

Your status will change when you get married and you need to discuss this with your future spouse because this will influence the “legal” workings of your married life.

Soré Cloete, senior legal manager at Old Mutual, says you need to decide which marital regime would work best for you and your partner.

These are your options:

Married in community of property

What is mine is yours, including our debt

You do not need a contract to be married this way, which means you will automatically be married in community of property if you do not sign an antenuptial contract. In this marital regime, all your assets will become one joint estate.

Cloete says that if you are married in community of property, your joint assets will be used to pay the bills, unlike when you are married out of community of property. This means that if you are married in community of property, you will be responsible for any debts your spouse incurs, as you are jointly liable.

Unfortunately, this also means that if your spouse becomes bankrupt or racks up huge debts, his or her creditors can legally attach your assets to recover the money owed to them.

On entering any legal contracts, the signature of both spouses is required. For example, you cannot nominate your child as a beneficiary on a life insurance policy without written consent from both of you.

Married out of community of property with accrual

You share the upside, but not the debt

You would need to sign an antenuptial contract. In this marital regime, you still own your assets, but you have to share whatever you accumulate during the marriage. At death or divorce, the party with the lesser growth in assets has a claim against the other for the difference in the growth value of assets, divided by two.

If you are married out of community of property (with or without accrual), you would not be responsible for your partner’s debt. You are also afforded the extra protection that your assets may not be attached to account for your spouse’s debts. Any bequests or inheritances are automatically excluded from your divorce-settlement agreement.

Married out of community of property without accrual

We keep everything separate

You need an antenuptial contract to be married this way. In this marital regime, you still own your assets and have no responsibility to share in the growth in assets, or each other’s debts.

Although no one wants to think about divorce when they are about to get married, the sad reality is that divorces are becoming more common.

“Upon divorce, the marital regime becomes important in terms of your retirement fund. If you are married in community of property or out of community of property with accrual, your retirement fund benefits will be taken into account when splitting assets at divorce.

“Retirement fund benefits are not taken into account upon divorce if you are married out of community without accrual,” Cloete explains.

The Recognition of Customary Marriages Act recognises customary marriages and one is assumed to be married under community of property unless an antenuptial contract prior to marriage has been signed.

Cloete says that although lobola is not required to be paid in order to be recognised, the payment of lobola helps to show that the traditions of a customary marriage were upheld.

Customary marriages must be registered at the department of home affairs within three months of taking place.

This is a very personal decision and depends on the level of trust between the parties. It is, however, a good idea to always have a separate bank account to control payments such as salaries separately.

In such a case, Cloete says you should ask the nominated executor to get the will of the deceased partner lodged with the Master of the High Court.

“The executor then has the power to ‘unfreeze’ the bank account of the surviving spouse,” Cloete says.

City Press reader Nicole is involved in a long-term relationship. She and her partner have decided to buy a home together. Because they are not married, Nicole wants to keep the transaction “business-like”.

“It is a good idea to ensure it is done in a strictly business way,” says Cloete, who advises the couple to have a properly drafted contract drawn up.

Publications

Publications

Partners

Partners