A recent study found that when it comes to life cover the average South African has a combined life and disability cover shortfall of at least R2.2 million. This translates to a total insurance gap of R34.7 trillion for South Africa’s 15.6 million earners.

South Africa’s life and disability insurance gap is measured every three years by the Association for Savings and Investment SA (Asisa) in partnership with True South Actuaries & Consultants. The insurance gap is defined as the difference between actual risk cover in place and the insurance need of South Africa’s earners and their families.

The insurance need is the amount of insurance cover required to meet a household’s financial requirements after a death or disability event, if the aim is to maintain the same standard of living as before the event until retirement age. This excludes immediate expenses related to the risk event, such as funeral costs, medical costs and the cost of adapting a home and car for the needs of a disabled person.

This year’s Insurance Gap Study shows that if households supported by earners had wanted to maintain their standard of living after the death of an earner, the average South African family would have required a life cover payout of at least R1.6 million to maintain their standard of living should an earner die. However, the average South African earner has life cover of only R0.6 million (R600 000) – hence a R1 million gap.

Rosemary Lightbody, senior policy adviser at Asisa, said the average earner would need to spend only an additional 4.6% of their monthly after-tax income to buy adequate life insurance. However, without adequate life cover in place, the average family would be forced to generate an additional monthly income of R5 362 to maintain their standard of living following the loss of an income earner or, alternatively, reduce household expenditure by 32%.

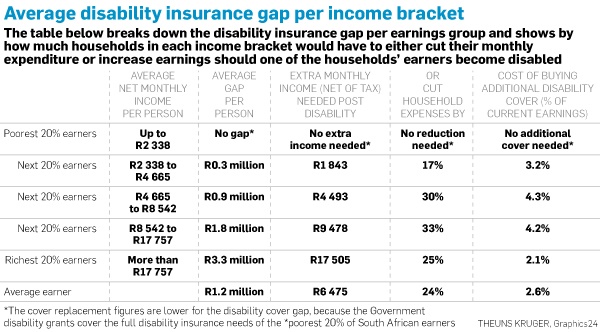

The survey found that the most significant shortfall occurred when it came to disability cover. The average South African earner would have had to make provision for disability cover of R2.3 million last year to help his or her family maintain their standard of living in case of disability. The reality is, however, that the average South African earner has disability cover in place of only R1.1 million, leaving a gap of R1.2 million.

Lightbody said the need for disability insurance is higher than for life insurance, because household expenses tend to decrease when a family member dies while disability tends to increase household expenses.

“When an earner becomes disabled, not only is the income likely to fall away, but household expenses also tend to increase due to the specific needs of a disabled person,” she said.

Lightbody said the average earner would probably need to spend an additional 2.6% of their after-tax monthly income to close the disability insurance gap.

“With the current shortfall in disability cover, the average family would be forced to generate an additional monthly income of R6 475 to maintain their standard of living following the disability of an earner or, alternatively, reduce household expenditure by 24%.”

Publications

Publications

Partners

Partners