I had a coaching session with a woman who was going through a divorce. She had reached out to me because she was expecting a cash windfall from a divorce settlement and she wanted to know that she would be making good financial decisions.

A cash windfall can come in different ways, for example, winning the lotto, an insurance payout, an inheritance, a retrenchment package or a divorce settlement.

While we all wish for a cash windfall that will change our financial lives for the better, without planning, the new-found fortune is no guarantee of a financially stress-free or independent life.

It is estimated that 70% of people who win the lottery end up completely broke. This speaks to the truth about money: it is not about how much money you make, but about the habits you build for managing your money, which will either break or make your finances. If you’re not disciplined, you will go broke, regardless of how much money you have.

Depending on your marital contract, if the marriage dissolves, there are always financial implications of some kind.

My client was married in community of property; this meant that everything they owned and owed was split in half for them to share equally. She was entitled to receive a payout from her ex-husband’s pension fund and she also had over a million rands in her bank account and wanted to know what her options were.

1. Keep your cash windfall a secret

Instead of telling your family and friends about your lump sum, rather keep it to yourself until you have a plan of what you want to do. Telling your family and friends will create unnecessary pressure on you to start dishing out money before you have a solid plan. And, instead of giving hand outs, give a hand up, such as paying for school fees.

2. Do nothing (until you have a plan)

If you suddenly receive a lump sum in your account and you do not have a plan, the best option for you is to do nothing. Don’t go listening to people telling you how you can double your money in six months’ time and the like. This is not a time to gamble with your money. Until you meet an expert who can advise you, leave your money in a money market account where it can earn some interest and it is safe.

3. Catch up with your retirement savings

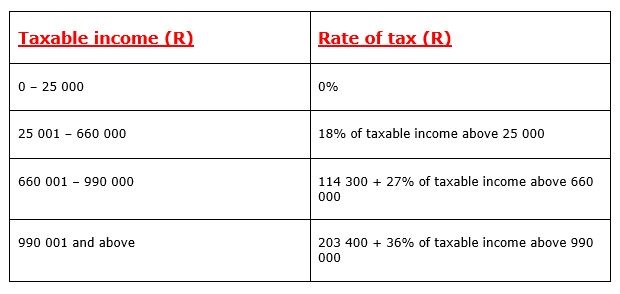

When receiving a cash windfall, especially as a payout from a pension fund, you have to think about the tax implication. If you choose to receive the money in cash, the consequence is a huge tax bill. You are taxed on a sliding scale: the more money you withdraw, the more you are taxed. This is to discourage early cash withdrawals to combat the low rate of savings towards retirement (which, I might add, most people don’t seem to understand).

The advisable option is to transfer the funds into either a preservation fund or a retirement annuity. The transfer is tax-neutral so you will not have to pay any tax.

There is the benefit, of course, of topping up your retirement savings, but another advantage of transferring into a preservation fund is that you are allowed one cash withdrawal should you ever need to (I don’t think it’s much of an advantage to withdraw from retirement savings, but I know life happens).

4. Seek expert advice

A good adviser can help you navigate the finance world and assist you in creating and executing a solid financial plan, however, you first need to find an ethical financial planner. Think of working with an adviser as a partnership and not just someone you relinquish all your power to. This means that you have to educate yourself first.

- Seek financial planners with reputable qualifications and experience – do they hold a CFP (certified financial planner) designation, how many years have they been in the industry, can they show you testimonials?

- Understand the type of financial adviser you are dealing with – are you looking for someone to advise you on insurance, retirement planning, wealth creation and preservation? Understand what their strengths are first.

- Do you trust them? This is a big one! Listen to your intuition and seek a second opinion.

5. Settle your debts

Due to high interest rates, debt costs money. I encourage you to pay off any debts you have so you can start to save and invest. The beauty of a cash windfall is that, if it is a large enough sum, you can pay most, if not all, of your debts in one go, but this does not solve the problem of how you got into debt.

Again, we go back to money habits: if you do not cultivate good financial habits with what you currently have, it is easy to repeat the same mistakes with a cash windfall and find yourself back where you started: broke.

Makhu is a personal finance coach

Publications

Publications

Partners

Partners