Financial advisers are good to have, but choose wisely, writes Brendan Dale.

It’s always exciting to start a new investment as it gives us that feeling of empowerment and the sense that we’re taking charge of our finances, planning for the future and doing the right thing.

We generally use a financial adviser and, knowing the strict financial regulations that are in place, it’s easy to take their word for things and to trust that they’re giving us the best, unbiased advice. But do they always share the information of fees and costs in a way that is understandable? And do we really comprehend the true cost of these fees?

THE NECESSITY OF FEES

Before delving into the negative side of things, it’s important to realise that all investments bear costs, and that these fees are indeed necessary and ultimately for our benefit.

Think about the costs involved in running an investment company – you would certainly expect professional staff, great IT systems, online statements and probably an app. All of these cost money, and it’s only logical that a fee is charged for services rendered.

Investment fees are inherently good as they ensure that our investments are managed securely and in accordance with relevant regulations.

ACTUAL IMPACT ON YOUR INVESTMENT

The negative effects of investment fees come into play when fund managers or advisers charge excessive fees and cause our investments to grow at a poor rate, or even a negative rate in some cases. Imagine you invest in a product that has a 12% annual return along with combined annual fees of 4% – these are called effective annual costs (EAC).

Your investment would effectively grow at only 8%, which is not much different to some of the fixed deposit offerings at banks. If your investment grew at 7% and had a 3% EAC, you may as well leave your money in a Capitec account, which currently offers 5% interest with no risk and will perform better than your investment.

Because investing should generally be done with a long-term approach, a bank account or fixed deposit will not suffice as these returns do not keep up with inflation. You do, however, need to ensure that you minimise the fees you’re paying and maximise the growth. A difference of only 1% in fees can have a dramatic effect over a 30- to 40-year period.

Here’s an example:

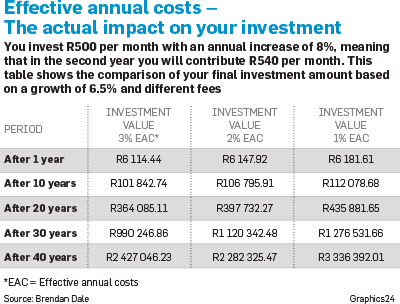

You invest R500 a month with an annual increase of 8%, meaning that, in the second year, you contribute R540 a month. The table shows the comparison of your final investment amount based on a growth of 6.5% and different fees.

Notice how the compounded effect of the higher fees erodes the investment value over time.

It’s also interesting to compare fees charged on your initial lump sum invested as well as potential penalties charged when moving your investment to a new provider.

A good way to get a true understanding of fees is to calculate the rand value of the fees and ask your adviser to give you a projection of fees charged over the next 30 to 40 years. However, not as a percentage, but rather as the real monetary value.

CHOOSING THE BEST PRODUCT

There is unfortunately no straight answer as to what the best product is as this depends on your personal circumstances and reasons for investing. You should, however, compare the annual costs of products and calculate the long-term effect of these.

Many index-tracking funds charge 0.75% or less, while actively managed funds can cost as much as 3% or more if there are performance fees. This difference could literally cost you R1 million or more, and the decisions you make today will affect your finances in the future.

Educate yourself, ask questions and get a second (or third) opinion. If in doubt, do some maths.

Dale is a personal finance blogger at takechargeofyourmoney.blog

Publications

Publications

Partners

Partners