Maya Fisher-French explains why your mortgage debt reduces so slowly

The first few years of paying off your mortgage can be a very disheartening experience. Despite paying in thousands, if not tens of thousands, of rands each month, the amount you still owe hardly budges.

In the first few years, interest makes up a very large part of the repayment. This is because of amortisation – the process of spreading the loan repayments into a series of fixed payments so that the loan is completely paid off by a specific date.

Read: Can I take out a mortgage with my siblings?

“As each monthly payment is made, part of the payment is applied as interest on the loan and the remainder of the payment is applied towards reducing the principal,” explains Ewald Kellerman, chief risk officer at Absa Home Loans. The amount allocated between interest and principle debt (capital) varies each month.

At the beginning of the loan, interest costs are at their highest. For home loans, where you are paying off the debt over 240 months, initially the majority of the payment is towards interest and you only pay off a small amount towards the principle debt. As time goes on, more of your payment goes towards the debt and you start to pay less interest.

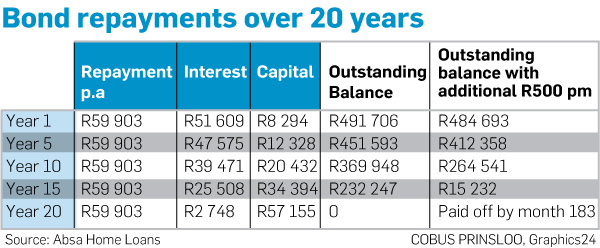

In the example provided by Absa, on a R500 000 mortgage, by the end of the first year you would have made a total repayment of R59 903 (R4 991.90 per month).

However, of this amount, R51 609 went to interest and only R8 294 to capital. So, by the end of year one, your outstanding debt has only reduced to R491 706.

In the fifth year, only R12 328 goes to capital. By now you have paid nearly R300 000 into your mortgage, but the balance has only reduced to R451 593.

It is only after thirteen years (by month 160) that the amount that is allocated to the capital equals the amount paid to interest. By this point the outstanding mortgage would be around R280 000. From here on, however, the outstanding mortgage reduces significantly each month as an increasing amount of your repayment goes to the principle debt. In your final year, nearly all your instalment goes to the principle debt, with only R2 748 paid in interest.

HOW TO REDUCE THE DEBT SOONER

If you want to reduce your outstanding mortgage sooner, then you need to pay in more each month. Every single extra rand you pay goes directly to paying off the debt, as the interest is already deducted from your agreed monthly instalment.

As you only pay interest on the outstanding debt, by reducing the debt with extra payments, you drive down your interest costs. This means a higher percentage of your agreed monthly instalment starts to go to capital repayment. This creates an acceleration effect which is why even a small amount like R500 a month can help you pay off your home loan several years earlier.

Using the same example, if you paid the extra R500 per month, by the end of year one your capital would have reduced to R485 993.

This means your outstanding balance has been reduced by a further R6 813 compared with if you had made no additional payment. Although you had made only R6 000 in additional payments, the extra R813 reduction is due to less interest as the balance has reduced. This means that a higher percentage of your normal monthly instalment has gone to principle debt.

By year five, your balance would have reduced to R412 358 – that means you would owe R39 235 less than if no extra payment was made. In this case, your additional payments over the last 60 months only came to R30 000. So, you have already saved R9 235 in interest.

By paying in the extra R500 per month, by year 16 you would have paid off your mortgage – in comparison, if you made no additional payments you would still have an outstanding balance of over R220 000.

The rule with any debt is that the more money you pay, the less interest you owe. The longer you take to pay off a loan, the more you will spend on interest.

SPEAK TO YOUR BANK

If you are paying in extra to your mortgage, it is worth informing your bank.

While the extra funds will be allocated to the principle debt, depending on your home loan agreement, the bank may reduce your monthly instalment so that you are still paying off the loan over the agreed 240 months.

Ask the bank to keep the instalment the same so that you can accelerate your debt reduction.

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners