We have received many questions from workers and self-employed people who have been affected by shutdowns due to the Covid-19 coronavirus. With incomes reduced, most people want to know what options are open to them.

CLAIMING FROM UIF

If you are employed and are required to enter self-isolation due to exposure, you can claim from the Unemployment Insurance Fund (UIF).

If your company has temporarily closed or reduced hours, you can also claim from the short-term UIF benefit. It is important that your company notifies the UIF if they are contemplating a short-term shutdown. The application has to be made via your company.

If you require more information, click on the tab “UIF benefits” and for details on how to apply, click on the tab for “manuals”, which takes you through the process.

BREATHER FROMDEBT REPAYMENTS

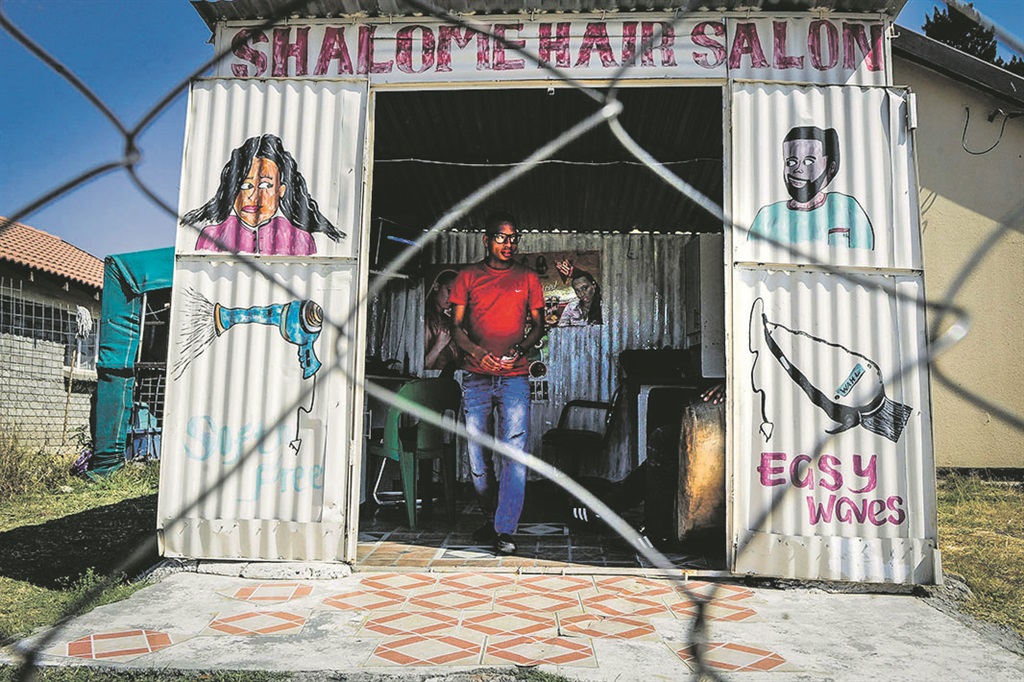

Many self-employed people, especially those in the tourism-related industries, have already been negatively affected and are seeing a significant drop in income.

The banks are assessing the situation, but the overall message is that you should contact your bank sooner rather than later to arrange a repayment schedule. Do not wait until you start missing debt repayments.

Absa said it was continuing to evaluate the impact of Covid-19, including its economic effect.

“While it is too soon to speculate about the impact on defaults, we are looking at various possible scenarios and related actions that may become necessary should customers find themselves in financial difficulty. We would like to heighten our call to our customers to approach us directly in the event of any form of uncertainty, including financial distress, during these unprecedented times.”

Ros Linstrom, spokesperson of Standard Bank, said customers who are in financial distress should contact the bank as soon as possible.

“The sooner the bank is informed, the sooner both parties can find a workable solution to address or resolve issues of financial distress.

“It is not in the bank’s interest to see a business fail, or a home lost. It is in both parties’ interest to find a workable solution.

“We do urge customers to contact the bank should they experience difficulties,” Linstrom said.

Charl Nel, head of communications at Capitec Bank, said they would continue to handle credit defaults case by case, using existing policies and procedures, which they believe are sufficiently robust.

“We do, however, urge all clients whose financial situation has been affected by the coronavirus crisis to not wait too long before getting in touch with us on 0860 66 77 89 so that we can assist through rescheduling where applicable.”

Nedbank told City Press that it was mindful of the economic impact the Covid-19 pandemic was likely to have on its clients, many of whom are already under pressure due to the country’s low levels of economic growth.

“In keeping with our purpose of using our financial expertise to do good for individuals, families, businesses and society, we will assess each case on its own merit.

“We will continue to be guided by our existing lending policies, which include a number of solutions designed to assist clients experiencing payment difficulties.

“Due to the extraordinary times we currently operate in, we will also continue to engage with regulators and industry bodies, and be guided by what government is looking into in terms of a comprehensive set of measures to mitigate the expected impact of Covid-19 on the economy,” the bank said.

- Bespoke payment arrangements, which allow consumers to repay their arrears over time.

- Restructuring of debts, where the latter includes possible extensions of terms and reduced instalments.

- The bank suspends/stops legal action under certain instances.

- Nedbank also supports the debt counselling remedies provided for under the National Credit Act.

Publications

Publications

Partners

Partners