Maya Fisher-French touches base with the contestants to see how they have adjusted their plans to cope with the Covid-19 coronavirus crisis

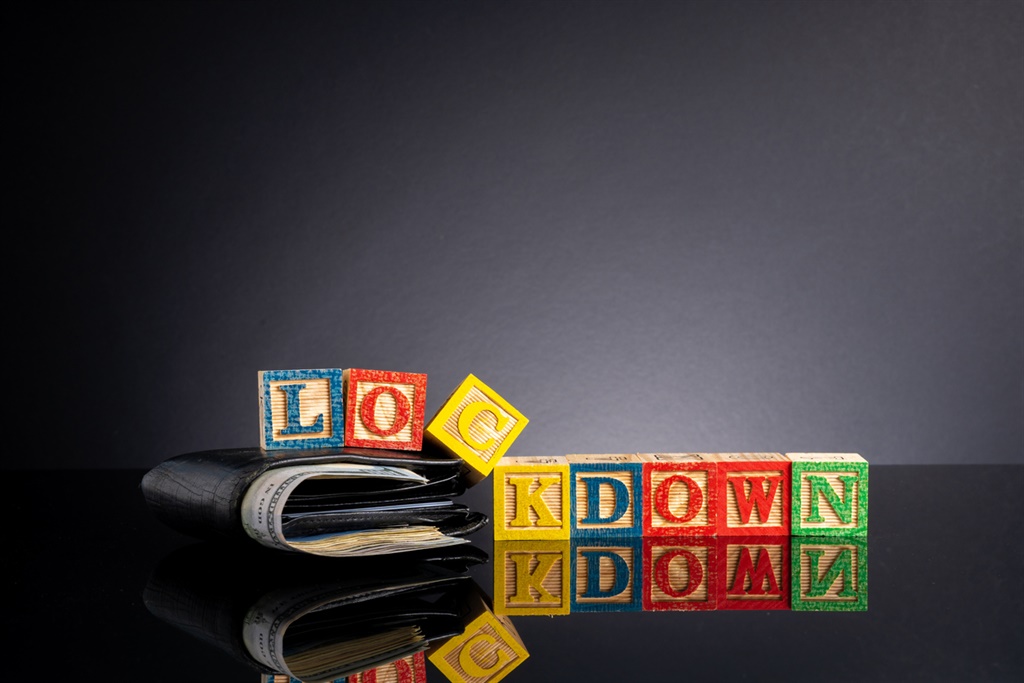

For our Money Makeover candidates, the lockdown has been an unexpected obstacle on their journey to financial freedom.

While Mishack has lost out on overtime pay, Colen is worried about his investment properties and Bellah’s construction business has ground to a halt.

Hashtags: #MoneyMakeover; #CPMoneyMakeover or #JourneyToFinancialFreedom

Facebook: @CPMoneyMakeover

Twitter: @CPMoneyMakeover

Instagram: @city_press

However, Nono and Catherien’s side gigs have been winners in the Covid-19 coronavirus meltdown.

READ: Meet the Money Makeover candidates

Peter’s wife is a speech therapist, so with schools closing and being unable to see clients she will not be earning an income. This has come as a blow to the couple, who had for the first time in years managed to live within their budget. Peter’s wife is looking into the possibility of working with adult clients via Zoom if the lockdown is extended.

Our candidates are more fortunate than most, as they had a handle on their finances and a plan to work with.

READ: How Peter replenished the emergency fund & stuck to the budget

MANAGING TENANTS AS A LANDLORD

Area manager and property investor Colen has significant debt on his various investment properties. Many of his tenants are university students, which is a concern if universities do not reopen in the new term.

“So far, I’ve managed to collect around 70% of rent. Some students’ parents promised that payments would be made after lockdown, since they are not allowed to move around. There is one working tenant whose company has been affected by the situation, but she paid 75% of her rent,” says Colen, who has contingency plans in place should a tenant be unable to pay.

He is prepared for a one-month rental holiday, which can be repaid once students receive their grants from the National Student Financial Aid Scheme.

“For the working tenants, I’m prepared to make a plan rather than lose them.”

Colen has benefited from the interest rate cuts, which will provide a buffer if his tenants are unable to repay. TPN, a tenant credit bureau, has developed the Rental Recovery Pack, which has free online solution agreements between landlords and their tenants, through which they can agree to a payment holiday or reduction to be repaid at a later stage.

Visit: tpn.co.za

USE THE HELP THAT IS AVAILABLE

Construction entrepreneur Bellah has been hard hit by the lockdown.

“It is hard now because after the financial year-end we are usually called for site inspection briefings. We can then start planning our work for the year.”

Now Bellah is unable to start work and has no income. She is awaiting feedback from her application to the Debt Relief Fund offered by the department of small business development. As she does not have full-time employees, she cannot apply for funds from the SA Future Trust, although this is a good option for small businesses with staff. Small businesses that cannot continue to pay their employees can apply for an interest-free loan of R750 per week, paid directly to employees.

Bellah has been provided with a three-month payment relief on her Absa cheque account overdraft. Interest will still accrue, so it is important that she resumes her repayment as soon as she can. She can apply for a debt repayment holiday on her mortgage, although that will be a last resort as the interest will be capitalised and will extend her repayment term.

Visit: smmesa.gov.za

MANAGE INCREASED PRESSURE FROM EXTENDED FAMILY

The lockdown will affect the income of many households, which will put pressure on relatives.

“I am receiving financial assistance requests from my family and relatives. I need to balance in-laws and direct relatives,” says Colen.

If you are in a similar situation, start by looking at your budget to see what you can realistically afford. If you are not travelling or spending on entertainment, can you create a fund to help family?

Setting boundaries and managing expectations is important. Also help them access the various relief measures, especially through their employers, which have been given relief by the Unemployment Insurance Fund.

PODCAST: How to make the most of your money in a crisis

USE THE TIME AT HOME TO WORK ON YOUR SIDE GIG

Nono is fortunate to be employed and is still being paid while on leave. This has given her an opportunity to work on her range of body care products, Salt and Light.

As she was able to produce hand sanitisers, she had an uptick in sales before the lockdown.

“For me, this time will be used to rest and work on my own brand and business. Unfortunately, we’ve had to suspend all production owing to the lockdown. But I’m grateful that we were able to make our mark and that even after this our hand sanitisers will be needed. We’ve got a preorder of more than 300 sanitisers! Those are the clients who are waiting for us to reopen.”

READ: Insurance policies you might not be aware of but need

Catherien sells biblical oils as well as a range of vitamins and cleaning products, which has been a huge success as people look for immune-boosting remedies.

“I am loving the freedom of working from home, and we are staying away from shops so the budget is doing well. I’m excited about my third income stream. I am learning so much, which I can apply at work. Because I love networking and helping people, this is really up my alley,” says Catherien, who is using WhatsApp and webinars to connect with her customers.

Her family is also using the opportunity of being at home to redecorate their new house, which needed some serious TLC.

As Bellah is not receiving an income from her construction business, she is finding ways to make some extra cash. She is making her own biltong, which she is able to supply to her brother’s workplace.

READ: Money tips for the self-employed

DON’T RELY ON THAT BONUS OR OVERTIME

Even if you are fortunate enough to still receive a salary, you are unlikely to receive any bonuses or salary increases this year. This needs to be built into your financial plan.

“The company I work for has some serious financial challenges. There is a good chance that there won’t be any annual salary increase and no bonuses will be paid out,” says Colen, who adds that he has an emergency fund that will keep him going if he needs to rely on it to meet the mortgage payments on his investment properties.

READ: Where to put your money in these uncertain times

Mishack has lost overtime money because events have been postponed or cancelled.

“Overtime helps one to pay for daily spending, so we have to budget even more.”

It is likely that Mishack’s bonus could be postponed or even cancelled.

Follow six South Africans as they take up the Absa and City Press Money Makeover Challenge and undergo a money makeover boot camp over the next six months.

Each person has been allocated an Absa financial adviser. The candidates will be required to complete certain financial tasks and stick to the budgets set out for them.

Personal finance expert Maya Fisher-French shares their stories.

Publications

Publications

Partners

Partners