Life happens and this could not be more evident than with the current Covid-19 coronavirus pandemic.

Getting into debt is not always because you were living a flashy lifestyle. In the absence of an emergency fund, sometimes people find themselves in a position where life forces them to take care of an emergency through a loan.

Even when you are experiencing an emergency that requires you to take out a loan, it is important to do your homework first.

READ: How to finally stick to your budget

Know that there are regulated lenders and those who are not regulated. Any company that operates within the framework of the law and National Credit Act, like banks, are regulated and are required by law to extend credit responsibly to consumers. On the other hand, you have mashonisas - who are illegal and unregulated, and operate without compliance with the National Credit Act (NCA). Only borrow from a regulated provider, otherwise you can easily fall prey to extremely high interest rates that will make it impossible to pay off the loan in the long run.

Hashtags: #MoneyMakeover; #CPMoneyMakeover or #JourneyToFinancialFreedom

Facebook: @CPMoneyMakeover

Twitter: @CPMoneyMakeover

Instagram: @city_press

When you have assured yourself that you are borrowing from a regulated provider, these steps will help you with your loan:

Calculate your affordability and stick with only what you need

Often, when people access credit, they go for what they qualify for and not what they can afford. They end up taking on more debt than they actually need. Make sure you go for only what you need. Remember this is money you still need to pay back.

Get your free credit report

Your credit report is a history of how you have handled and managed debt in the past. Whenever you apply for a loan or any form of credit, the creditor will pull your credit report first. This informs them whether to extend you the credit and at what interest rate they should lend you money.

Know the interest rate on your loan

The interest rate on a loan is effectively the cost of the loan. The higher the interest rate, the more expensive it is to service that loan. Don’t just focus on your monthly repayments, always familiarise yourself with how much interest you are paying towards your debts.

READ: Killing the credit card debt

Now that you have been granted a loan and you have some financial relief to fund your emergency, it is time to go back and think about how you will pay off the loan.

You will have to look at your budget and either scale back on wants or find a way to bring in extra income so you can direct some of those funds to pay off your loan.Your credit score depends on paying your financial obligations on time in full. This means that, every month, you should pay at least the minimum you have agreed to pay. If you don’t, this will negatively affect your credit score.

To speed up your loan payment, you can opt to pay extra every month, even if its just R100. This makes a big difference in the long run. Every little bit goes a long way to make sure you get out of debt sooner.

If and when you finally decide you want to get out of debt, you have to come up with a plan of how you are going to do it. Without a plan, you are just wishing.

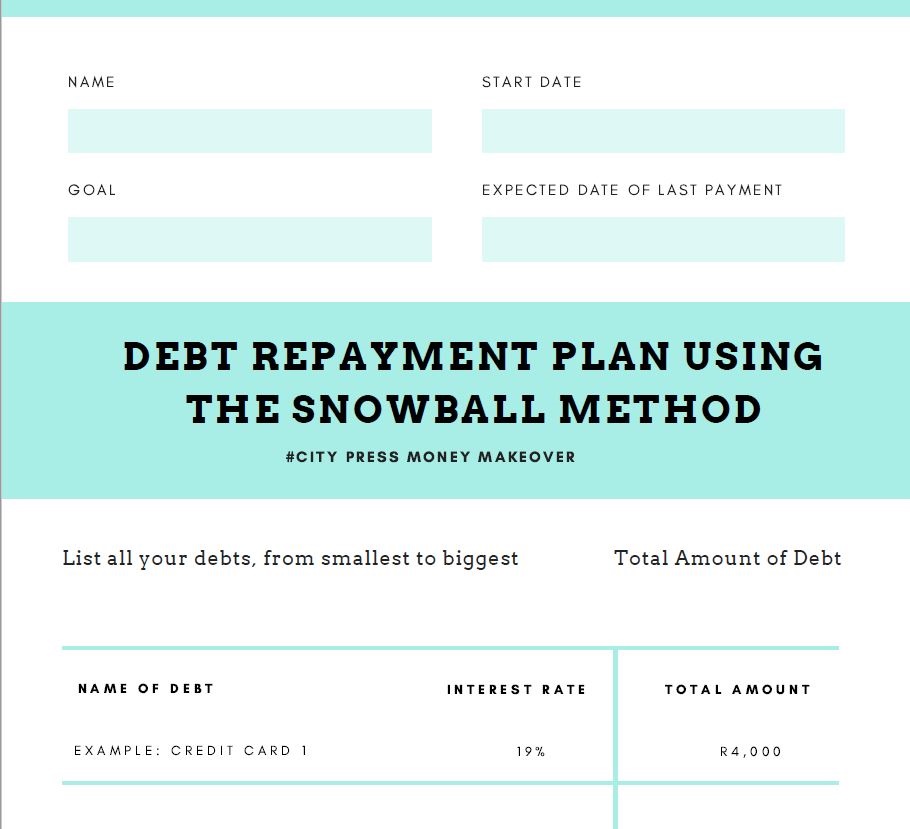

List all your debts, starting from the smallest to the largest. Focus on the smallest debt first by paying a little extra money every month (remember, even what seems like a small amount goes a long way) while paying the minimum payments towards all the other debts.

Once the smallest debt is paid off, roll that payment towards the next debt on the list – this is called the snowball method.

Download an interactive example of the Snowball Method here

Getting out of debt takes commitment and directing every spare rand towards paying off the debt. You must resolve that no matter how long it takes; you will become debt free.

Each person has been allocated an Absa financial adviser. The candidates will be required to complete certain financial tasks and stick to the budgets set out for them.

Personal finance expert Maya Fisher-French shares their stories.

Publications

Publications

Partners

Partners