The world economy is enjoying a synchronised upswing, in which most regions are generating good growth despite political upsets in some parts of the world.

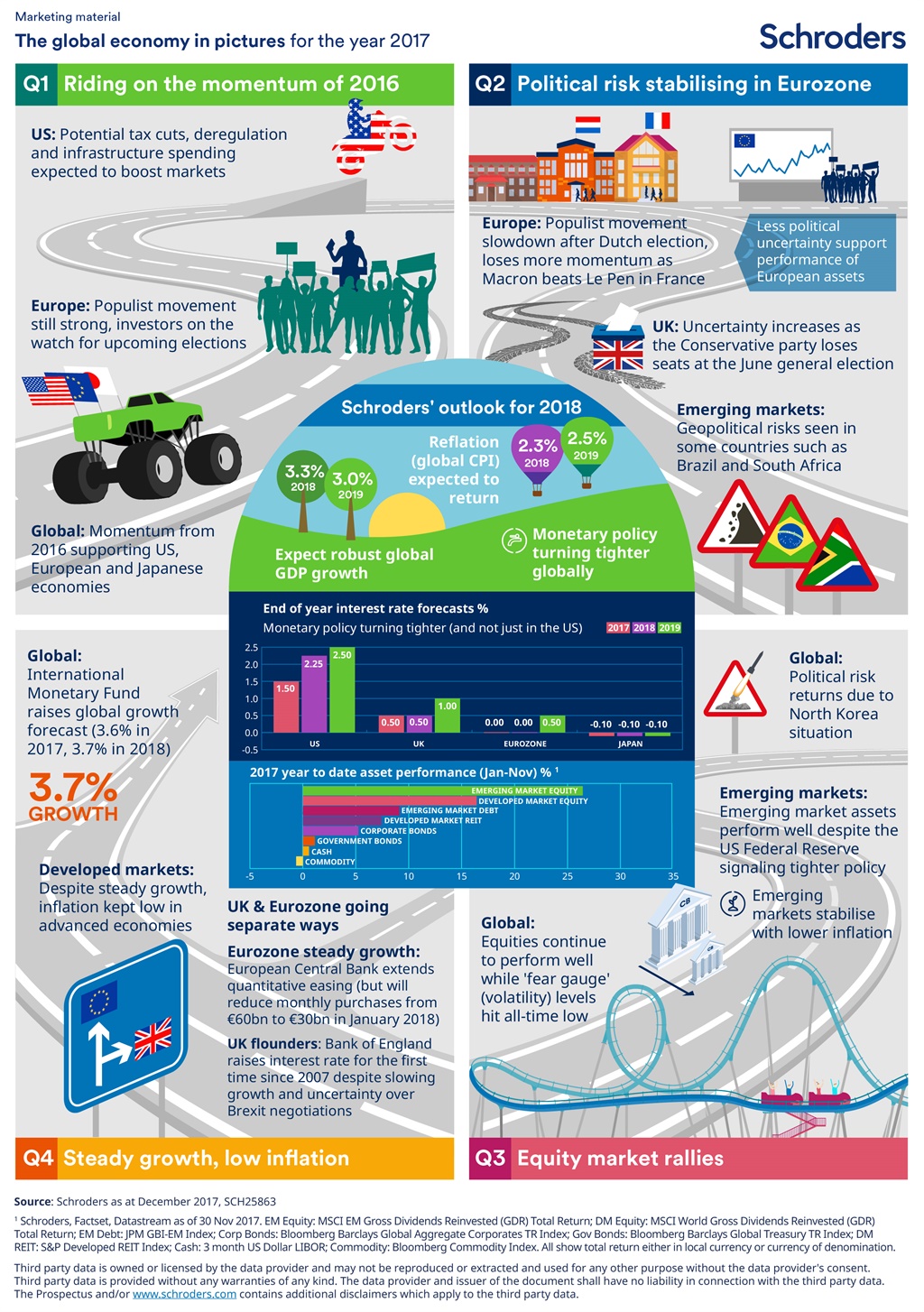

As a result, Schroders, a global asset manager, has upgraded its global growth forecast for 2018 to 3.3% from a previous estimate of 3.0%. This marks a modest acceleration from 2017, which is also upgraded to 3.2% from 3%. If correct, this would make 2018 the strongest year for global growth since 2011.

So will another year of robust growth cause an acceleration in inflation and bring tighter monetary policy? So far, the increase in activity has not done so, but the question is whether the Goldilocks combination of strong growth and low inflation can persist in 2018.

Higher growth and inflation expected

Both advanced and emerging economies are forecast to enjoy stronger growth in 2018. In the developed world, we have raised our US and eurozone projections from 2% to 2.5%, and from 2% to 2.3%, respectively.

Japan is forecast at 1.8% (previously 1.5%) and in the emerging world we raise our growth forecast to 4.9% (previously 4.8%). The latter reflects better growth expected in most of the Bric economies (with the exception of India where expectations have been revised downward) and incorporates a slightly stronger figure for China in 2018 at 6.4%.

We forecast inflation at 2.3% in 2018 (up from 2.2%), an outcome reinforced by higher oil and commodity prices, and reflected in the pick-up in producer price inflation around the world in recent months.

Waning Goldilocks environment

In this respect, 2018 will see a fading of the Goldilocks combination of better-than-expected growth and weaker-than-expected inflation. Structural factors such as the effect of technology remain important, but cyclical forces suggest that inflation will begin to catch up with the strength of economic activity next year.

Monetary policy: turning tighter (and not just in the US)

Such an outlook supports a tightening of monetary policy by the US Federal Reserve (Fed) and with fiscal policy providing an extra boost to growth, Schroders now expects three rate hikes next year after an increase at the December 2017 meeting. The Fed funds rate is now forecast to end 2017 at 1.5%, 2018 at 2.25% and 2019 at 2.5%.

Elsewhere, we see both the European Central Bank and Bank of Japan as moving their respective monetary policies in a tighter direction. In Europe, we believe quantitative easing will end in September 2018 and rates will rise in 2019. In Japan we assume that yield curve control continues; however, we see a strong likelihood that the Bank of Japan will raise the 10-year government bond yield target, representing a turning point toward tighter policy.

Reflationary outcomes most likely

The above macroeconomic tail risks point to a reflationary environment and the scenario analysis reflects this.

Our two reflationary scenarios are “global trade boom” and “US fiscal reflation”. The “global trade boom” results in stronger growth and inflation as the upswing pushes commodity prices higher. Meanwhile the “US fiscal reflation” scenario sees a fiscal boost, incorporating deeper tax cuts and increased infrastructure spending, driving inflation higher. While both scenarios result in a rise in inflation, in the latter this is concentrated in the US.

Stronger economic activity is also a feature of the “productivity revival” scenario although here inflation does not accelerate as the extra growth is met by increased productivity. There have been encouraging signs of late that productivity is improving in the US and this scenario assumes it continues over the forecast period.

Downside risks: deflation and stagflation

On the downside, there are two scenarios that could move in a deflationary direction: “secular stagnation” and “bond yields surge”. In the former, the current cyclical upswing fades and the world economy falls back into a weak deflationary trend. Although this doesn’t look likely at present, it is important to acknowledge that significant structural headwinds to global growth do still exist (for example, high levels of debt and deteriorating demographics).

The “bond yields surge” scenario sees a sharp tightening of financial conditions as the Fed and European Central Bank unwind their quantitative easing policies, which leads to a deflationary environment.

There are two scenarios that result in a stagflationary outcome (in which growth is weak but inflation rises): “inflation accelerates” and “protectionism rises”.

As its name suggests, the “inflation accelerates” scenario sees higher inflation but slower economic growth as central banks tighten policy in response. The “protectionism rises” scenario is one in which countries raise tariffs in response to increased protectionism. This in turn results in a deceleration in activity and higher inflation as trade contracts and import prices rise.

From Goldilocks to reflation

2017 was characterised by a combination of steady growth and low inflation – a Goldilocks environment in which activity was neither too hot nor too cold to cause a significant acceleration in inflation. This looks set to change in 2018.

Next year, we expect inflation to accelerate alongside growth and monetary policy to turn tighter. According to our scenario analysis, the risks are skewed towards a reflationary rather than a deflationary environment given our view on the increased likelihood of fiscal support and a potential global trade boom.

Keith Wade is chief economist at global asset manager Schroders.

Publications

Publications

Partners

Partners