Eskom is in trouble.

It is drowning in debt and cannot meet the demand for electricity.

If it were any other business, it would probably be liquidated and sold for scrap provided there was anything left to salvage.

The irony of it all is that Eskom is a state-enforced monopoly in a highly profitable market where demand for its product is not just high, but extremely price-inelastic, meaning Eskom can charge higher tariffs without a large decrease in the quantity of electricity demanded.

That it is teetering on the brink of collapse is an indictment of the incompetence of the South African government.

Eskom’s financials illustrate utter financial chaos.

This short analysis will examine Eskom’s financial statements since 2007 from two main aspects: returns generated on certain inputs (production inputs, investment, and equity) and how Eskom’s debt measures up to its assets.

Returns on inputs measure how efficiently a firm is functioning and the relationship between debts and assets illustrates how well a firm is managing its debt.

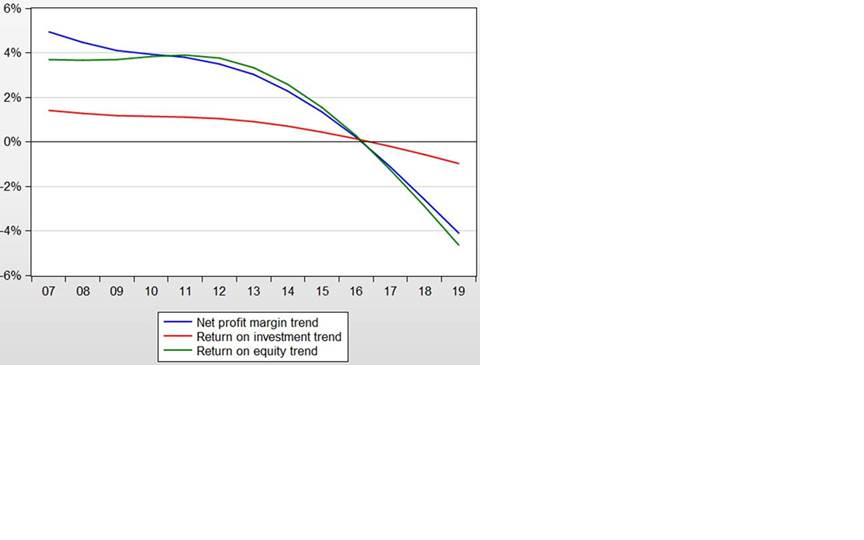

RETURNS ON INPUTS

Net profit margin

The net profit margin is indicative of how well a firm generates a return on its production inputs after accounting for after the fact expenses such as taxes.

At the end of the 2019 financial year, Eskom’s net loss was a staggering -11.52%, down from -1.13% in the previous financial year.

Return on investment (ROI)

The ROI is effectively a measure of how well a firm can capitalise on its total assets.

Eskom’s ROI for the 2018/19 financial year was -2.73%, down from -0.32% in the previous financial year.

A negative ROI means Eskom’s assets are either useless in and of themselves (such as Medupi), or that upper management at Megawatt Park are unable to generate a profit from its assets.

Return on equity (ROE)

Equity is the amount of money that owners of a firm (in Eskom’s case it’s the taxpayer) would get back if the firm were to be liquidated and all of its assets (total assets) were sold off to pay off its total outstanding debt (total liabilities).

Equity can be thought of as net assets.

ROE measures the return on net assets (as opposed to total assets) generated by a firm.

The ROE was -13.54% for the 2018/19 financial year, down from -1.37% in the previous financial year.

To put this in simple terms: for every rand of equity in Eskom, a net loss of 13 cents was made.

This is almost a 10-fold increase from the net loss on every rand of equity in the 2017/18 financial year.

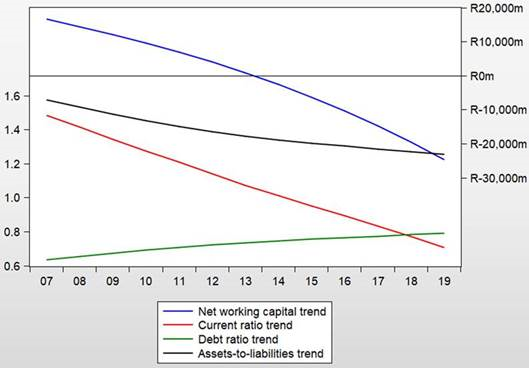

ESKOM’S DEBT SITUATION

Net working capital

Net working capital is the result of subtracting current liabilities from current assets.

It is a useful measure for determining whether a firm is able to pay off its current debt.

For 2018/19, Eskom’s net working capital was just shy of -R44.1 billion, more than double the negative net working capital of the previous financial year which stood at -R20.6 billion.

Eskom thus had an excess of R44.1 billion in current liabilities relative to its current assets.

In simple terms, if Eskom’s short-term liabilities had to be paid off now, it would fall just over R44 billion short of its payment obligations.

These figures were calculated according to Eskom’s financial statements as of March 2019; odds are that this shortfall may have increased by now.

Current ratio

The current ratio serves the same purpose as that of net working capital. It just represents the relationship between current assets and current debt as a ratio rather than as a net nominal amount.

On this calculation basis Eskom cannot pay off its current debts.

For every R1 in current liabilities, it only had R0.59 in current assets. Relative to R0.78 in the previous year.

Debt ratio

The debt ratio measures the amount of total liabilities for every rand of total assets held by the firm.

Put differently, it measures how much of the firm’s assets are funded by the firm’s creditors.

Eskom’s debt ratio stood at 0.8 at the end of the 2018/19 financial year, up from 0.77 at the end of the 2017/18 financial year, meaning 80% of its assets are funded by creditors.

Assets-to-liabilities ratio

This ratio simply measures the amount of total assets Eskom has relative to every rand in total liabilities.

The most worrying aspect regarding Eskom is its debt.

Even though it might have more total assets than total liabilities, this ratio is extremely low and has been getting lower over time.

The last time Eskom had at least R1.50 for every rand in total liabilities was in 2008.

Currently, Eskom only has R1.25 in total assets for every rand in total liabilities.

Eskom is in financial ruin.

It is doubtful whether it is now even viable for privatisation anymore.

The fundamental problem with state-owned enterprises like Eskom is that there is absolutely zero economic incentive on the part of management to run it as a profitable company.

There isn’t even a political incentive to manage it effectively.

The ANC, despite all its failures, has been kept in power.

When Eskom’s next financial statements are released around September, it is highly improbable that they will reflect a healthier financial condition.

One can only hope that the government comes to its senses and allows private electricity generators to contribute to the grid and save us from a catastrophic collapse of the entire national grid.

- Jacques Jonker is an intern at the Free Market Foundation. He has a BCom in Law and a BCom (Hons) in Economics from the North West University. The views expressed in this article are those of the authors and not necessarily those of the Free Market Foundation.

*Authors Note: This article was amended on January 24 to reflect a change to Eskom's ROI after a minus sign was left off the two figures. This has been corrected.

| ||||||||||||||||||||||||||

Get in touchCity Press | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Rise above the clutter | Choose your news | City Press in your inbox | ||||||||||||||||||||||||||

| City Press is an agenda-setting South African news brand that publishes across platforms. Its flagship print edition is distributed on a Sunday. |

Publications

Publications

Partners

Partners