President Cyril Ramaphosa hosted more than 1000 delegates in Sandton at last week’s inaugural investment conference.

Initially announced during Ramaphosa’s first state of the nation address earlier this year, the conference was earmarked as one of several initiatives that would be implemented to improve economic growth – and partnership was positioned as the key driver of this.

But while the summit was a positive start in many areas, both public and private sector have a lot to do in order to realise success.

As part of Ramaphosa’s drive to raise $100 billion of investment in the next five years, the conference aimed to announce that South Africa is open for business – with planned initiatives including an expansion of existing operations and establishment of new ones.

It reinforced the view that investment is a key enabler of job creation and growth for South Africa – and that government is committed to this.

Adding a tangible aspect, Ramaphosa announced that government is working with the World Bank to improve the ease of doing business in South Africa, fast track investment projects and reduce red tape.

He also said that government would be crafting a new strategy for attracting foreign direct investment.

According to Ramaphosa, reduction of red tape and the restoration of lost confidence, would be achieved through a number of measures – namely, the newly revised mining charter; separate legislation for the oil and gas sector; signing off of the remaining renewable energy supply agreements; ensuring allocation of high-demand spectrum; reviewing the visa regime; reprioritising the budget towards activities that will boost growth; and the provision of special economic zones where companies can act in an environment of lower key input costs and reduced corporate taxes.

Dealing with issues head on, the president addressed the corruption concern at state-owned enterprises and emphasised the need to restore credibility at these institutions by ensuring that leaders of these institutions have the relevant skills, experience and integrity.

He also attempted to allay land reform fears by pointing out that South Africa has a robust Constitution, a firm rule of law, an independent judiciary and robust legislation to protect foreign investments.

In terms of numbers, R290 billion was announced in actual investment and R400 billion worth in pledges still needs to be actualised.

At Momentum Investments, we believe this is a firm step towards improving sentiment, but we need to reduce barriers to entry and increase competition to ultimately lower costs for consumers, create jobs for South Africans, promote inclusive growth and stimulate regional activity.

South Africa’s 18.6% investment to GDP ratio (World Bank data) is low relative to other key emerging markets – with Turkey at 30%, Russia at 23%, India at 31%, Poland at 20%, Mexico at 23%, Malaysia at 25%, South Korea at 31%, Hungary at 23%, Kenya at 19% and Sri Lanka at 36%.

This suggests vast room for improvement.

To achieve the increased investment ratios required to even attempt to enhance South Africa’s competitiveness against its emerging market peers, there is a dire need to quell finger-pointing and buck-passing and instead to foster collaboration between public and private sector.

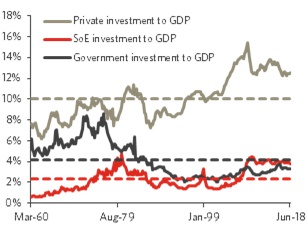

Currently private sector investment and spend by state-owned enterprises is running above its long-term average against GDP, while spend by government is running below its long-term average against GDP (see chart 1).

Chart 1: Fixed investment spending share of GDP (%)

Source: IRESS, Momentum Investments

In the February 2018 budget, Treasury admitted government and banks could not fund South Africa’s infrastructure programme without the help of the broader private sector.

A meaningful partnership between government and the private sector could boost infrastructure maintenance and expansion spend; which could in turn create economic efficiencies, establish greater competitiveness and improve overall growth and living standards.

• Sanisha Packirisamy is an economist at Momentum

Publications

Publications

Partners

Partners