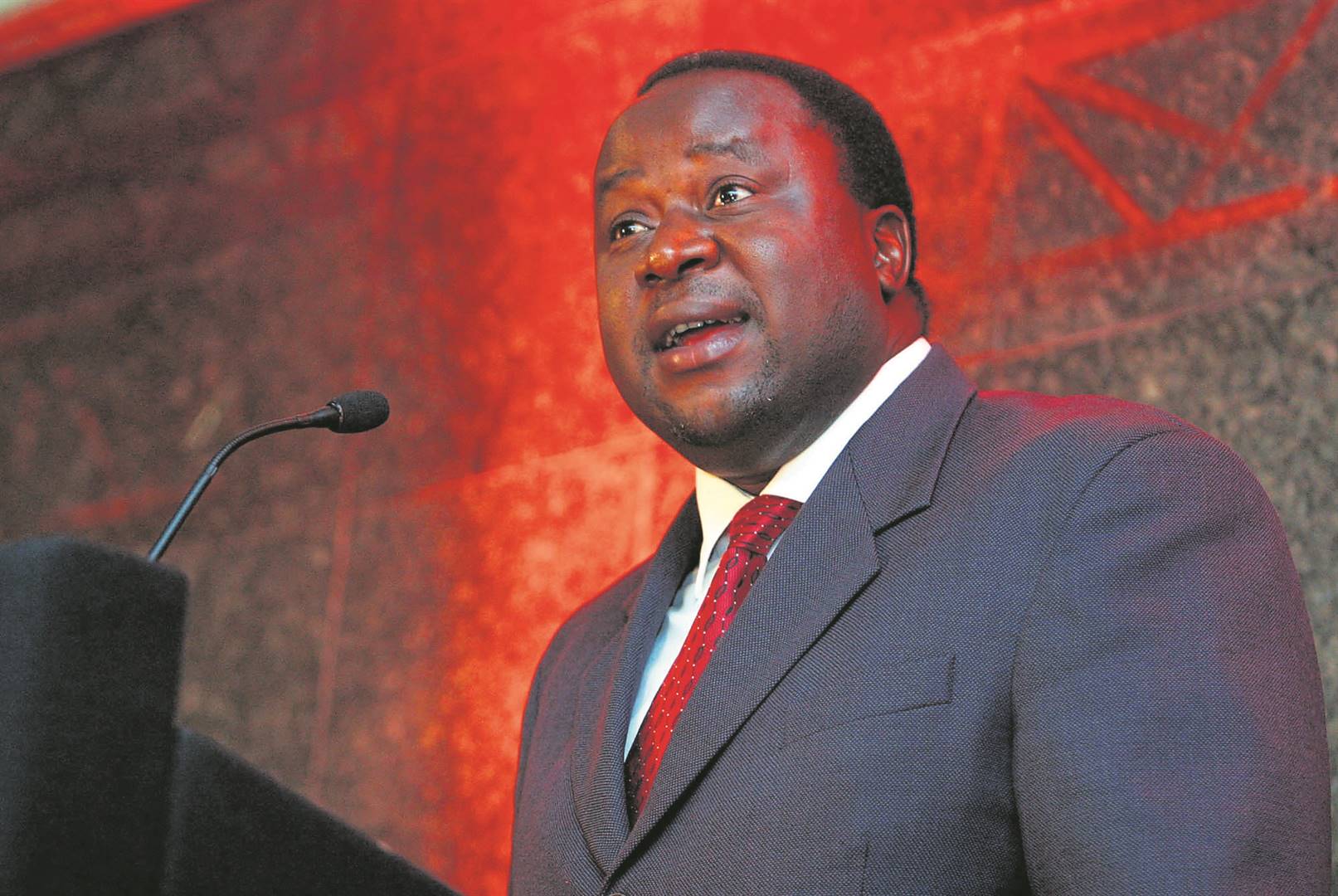

Finance Minister Tito Mboweni presented his medium-term budget policy statement yesterday during extremely difficult fiscal circumstances.

At the time of the national budget in February, the growth rate was forecast to be 1.7% for the 2019/20 fiscal year and the minister has revised this to just 0.5%.

This does not compare favourably with growth rates in the rest of sub-Saharan Africa. The estimate of the budget deficit for 2019/20 has been revised upwards, from 4.5% to 5.9% of GDP, while the debt to GDP ratio for the same period is also expected to be considerably worse, at 60.8% compared with 56.2%, ballooning to 71.3% in 2022/23.

Mboweni also announced an estimated shortfall in tax collections of R52.5 billion for the 2019/20 fiscal year.

This state of affairs has a multiplicity of causes: in economic terms it is largely the result of an extremely sluggish economy, inefficiency in revenue collections by the South African Revenue Service and high government expenditure, particularly in relation to the public sector wage bill, state-owned entities and wasteful expenditure.

Read: No more free lunch for ‘spoilt brat’ Eskom

The minister was at pains to point out that the medium-term budget policy statement was not the same as the national budget presentation and, accordingly, the documents released contain little detail regarding the additional revenue measures that he stated as being necessary to stabilise the fiscal framework.

However, the statement did point out that, following several years of tax increases, revenue options are constrained. The tax-to-GDP ratio is approaching its 2007/08 peak of 26.4%. The 2019 National Budget included R10 billion in tax increases for 2020/21 and tax policy measures to raise this amount will be announced in the 2020 Budget.

It is widely recognised that the tax rates in South Africa are relatively high.

The corporate tax rate of 28% is somewhat of an outlier if one compares it to, for example, the UK’s rate of 19%, proposed to drop to 17% from 2020, and the US’s rate of 21%.

Personal income tax rates are also high, with the top marginal rate of 45% reached at the equivalent of about $100 000 of annual taxable income. South Africa also has a thin band of personal income taxpayers: about 14 million (roughly 25% of the population) are registered with the revenue service and, of those, only about 7.6 million pay any income tax at all.

Of these, about 540 000 (less than 1 person in every 100 of the population) pay more than 50% of total income tax. Thus, the loss of high net worth individuals is especially detrimental to the fiscus.

It is therefore unlikely that we will see increases in the rates of tax for individuals or corporates in next year’s budget.

It seems more likely that additional revenue will be raised by not fully adjusting for the effects of bracket creep and, possibly, increases in the fuel levy.

Despite the fact that the effects of increases in the fuel levy are similar to the effects of increases in the VAT rate, they avoid the political complications associated with the latter.

Rather than increasing taxes, the government should focus its efforts on reducing expenditure, especially fruitless and wasteful expenditure and rebuilding revenue collection capacity at the revenue service.

In simple terms, the fragile economy cannot sustain further tax hikes.

It is encouraging to see that the minister promised R1 billion to the revenue service for the next two years to bolster efforts to combat corruption and improve revenue collection.

If this investment is effectively utilised, it should yield returns many times over.

| ||||||||||||||||||||||||||

Get in touchCity Press | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Rise above the clutter | Choose your news | City Press in your inbox | ||||||||||||||||||||||||||

| City Press is an agenda-setting South African news brand that publishes across platforms. Its flagship print edition is distributed on a Sunday. |

Publications

Publications

Partners

Partners