The Covid-19 coronavirus has brought many challenges to almost all aspects of our lives, including health; spirituality; academic and developmental growth; business, including sports and culture; career; finances; as well as family and other social capital.

I can’t overemphasise the importance of complying with government legislation and medical guidance to reduce the overwhelming impact of Covid-19 on the resultant consequences, which include loss of life (as we have experienced starting in the Western Cape), the collapse of businesses (big and small), job losses, disruption of life cycles, separation of families and so on.

The loss of South Africa’s investment-grade rating to Ba1, leading to the rand falling to a record low to more than R18 to the dollar at the end of March, is a reality that we have to build into our financial plans for the foreseeable future.

However, the most complex challenge we are faced with is Covid-19 and its impact on us. This article seeks to highlight some of the silver linings on this dark cloud of Covid-19, so that those who can may leverage or take advantage of the opportunities.

1. Interest rates reduction

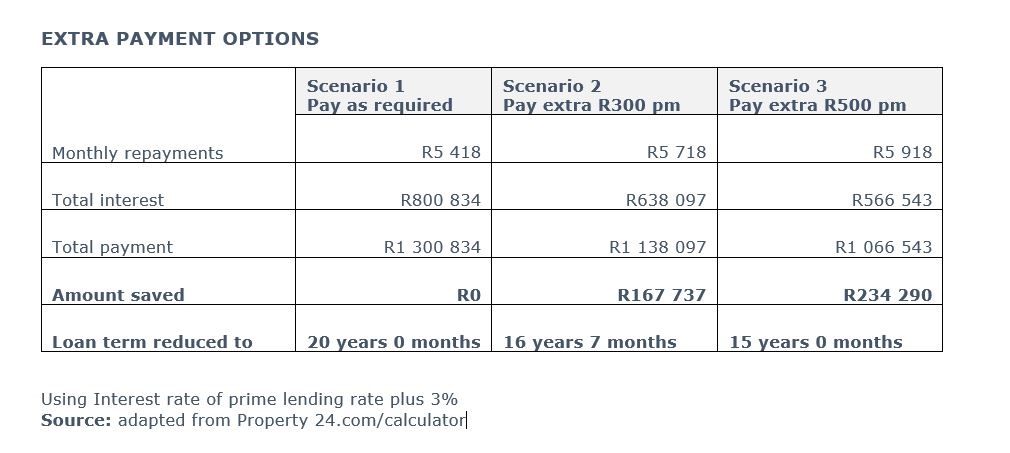

The decision by the SA Reserve Bank to reduce the repurchase rate by 100 basis points from 6.25% to 5.25%, which automatically led to a reduction in the prime lending rate by the same percentage from 9.75% to 8.75%, is a significant relief to those of us who have debt.

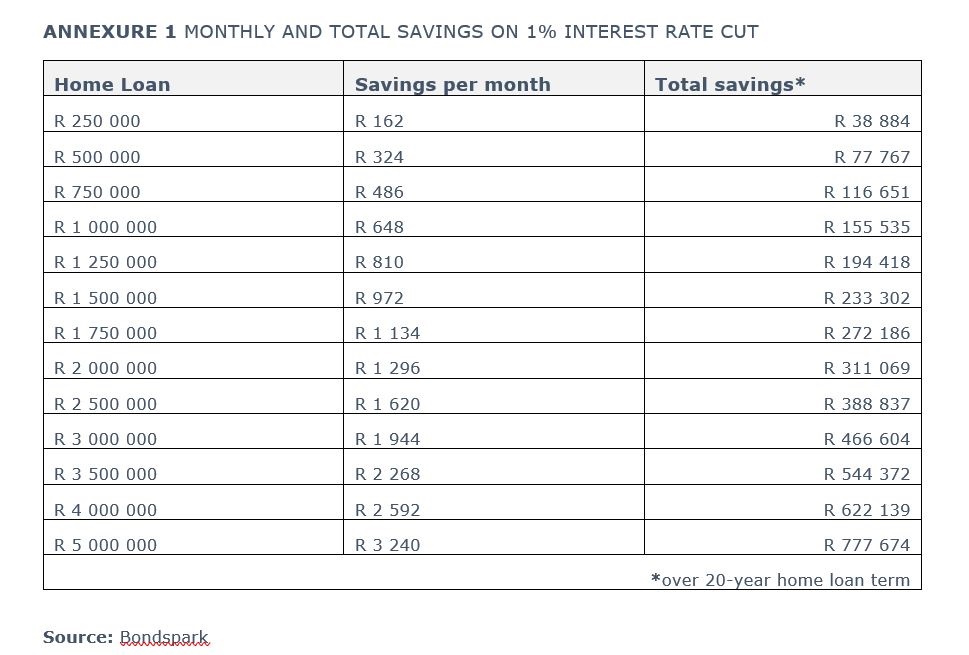

Annexure 1 below gives examples of the amount of monthly and total savings that can be realised from the 1% reduction in the case of a 20-year loan.

It is with these benefits in mind that I would discourage those who still have their full income from taking the payment holidays offered by lenders because a lender continues to charge you interest even during the holiday.

Whereas the payment holiday extends your repayment period, it can also increase your final payment in a significant way owing to compound interest – which is calculated not just on the initial amount but also the accumulated interest charged to date, which makes the loan grow faster – especially if you still have a longer period before you pay up the debt. You may want to ask the lender to share with you the impact of the holiday before you consider it, or use the calculators available on financial services institutions to do the calculations yourself.

The alternatives of paying the outstanding amount as a lump sum at the end of the period or within 12 months in addition to your normal monthly payments are also risky, unless you are guaranteed extra income by a reliable source. Failure to honour that may lead to penalties.

Those who keep their instalments at the same level or pay a little more than they were paying before the reduction will benefit even more by saving on the cost of the loan and pay off the debt even sooner.

Settling the debt faster improves your personal balance sheet and improves your liquidity so you can have more funds to direct towards other priorities, particularly in times of an economic depression or loss of employment. This can be easily achieved by those whose salaries will remain unchanged during this period.

The savings realised from other debts, such as higher purchases, car repayment or credit card, which could be for shorter periods and may be of higher interest rates, will also be significant even though savings in percentage terms may be different.

All banks have on their websites calculators that demonstrate the implications of reductions and increases on all the types of loans they offer. You are encouraged to look at other options by playing around with these tools.

Just to emphasise the significance of the current prime lending rate, from January 2000 to February this year, prime averaged 10.5%; and as recent as May 2003 prime was at 17%, and down to 8.5% in 2013.

Take advantage of the Covid-19-induced significant prime rate reduction.

2. Fuel price

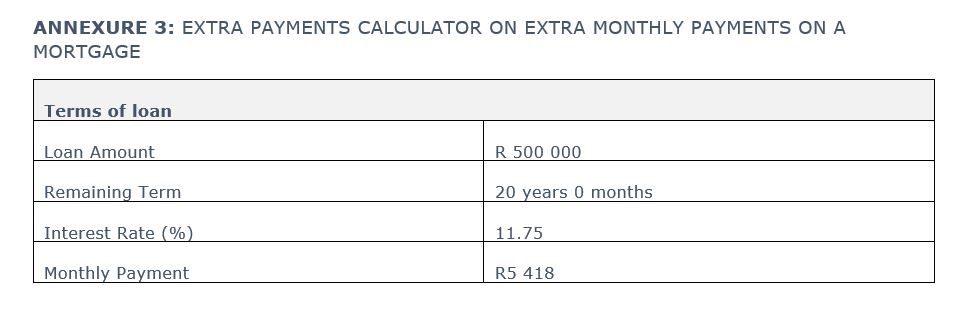

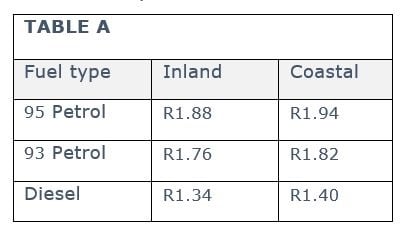

We have recently seen a reduction in fuel prices. According to the Automobile Association of SA, fuel prices will come down even further as a result of Covid -19, which has plunged our markets so badly that investors are looking at safe-haven assets (away from oil) for investments. As a result, the April fuel price in South Africa, taking into consideration the fuel and Road Accident Fund levies on petrol and diesel increase announced during the budget speech in February and becoming effective in April, the net decrease is significant as shown in table A below.

This is despite the continued weakness of the rand relative to the dollar.

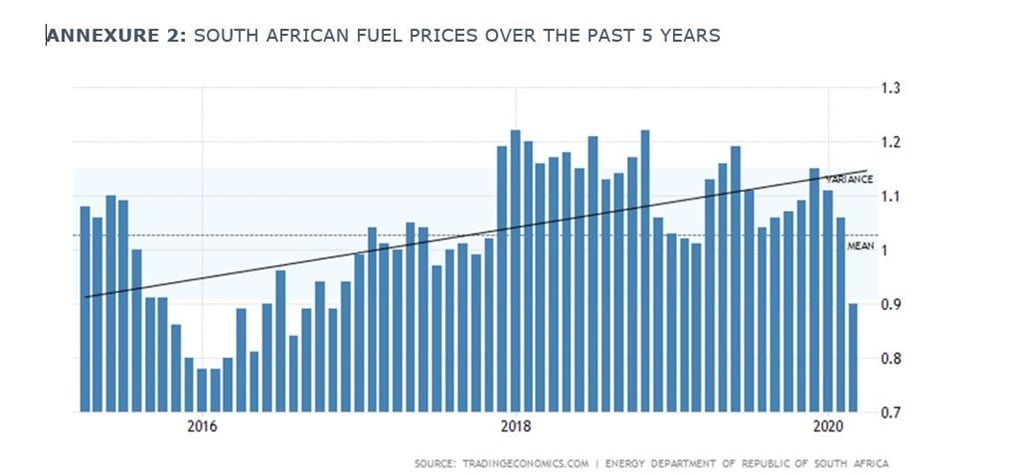

Annexure 2 below shows the fuel price trend in South Africa. The current fuel price is the lowest it has been since 2016. The rand savings per type of fuel from March 31 to April 1 is outlined on the shown table A below.

Of course, the April decreases come into effect during a lockdown period, but we don’t know how long they will last. The savings from the reduced fuel price could be used to increase monthly debt repayments and benefit us meaningfully.

An annual average of R200 monthly saving on petrol used to increase monthly payments on a 20-year property loan can make a meaningful impact. Using the same R200 saving to a high-interest credit card loan payment can also save you a significant amount.

3. Less usage of transportation

The lockdown means our petrol and diesel usage will be significantly low. The 21 days savings made on your usual petrol/diesel costs or taxis and any other form of transport can be put to good use in many ways. For bigger families who have to travel to different destinations, their combined savings can be bigger.

Again, the savings can be used to reduce your debts or put you ahead with instalments and lower the interest on debt. Being ahead on your payments lowers the cost of your debts for the duration of your debt, as discussed earlier.

4. Qualifying for a higher loan amount – property and other assets

The amount of loan or debt for mortgage, cars and other debts that you qualify for largely depends on your net income and prevailing interest rates. Lower interest rates can mean that you qualify for a bigger bond, which you may not have qualified for previously because the monthly payments are less.

Always take a long-term view and make sure that you will be able to cope when rates go up again.

5. Opportunity to invest in shares at lower prices

If you have always wanted to invest in listed and/or unlisted businesses but was worried about the higher prices, and you have manageable or few debts to worry about, this could be a good time to consider buying those shares.

Despite the lower prices of listed company shares and low valuations of unlisted shares, it is important to remember that investing is a risky business.

Prices can fall even lower than they have already. It is for this reason that I discourage people from borrowing money to invest in businesses, whether listed or unlisted.

Having said that, investing remains a good way of providing for your and/or your family’s financial future.

Those of you who have retirement funds have already invested in shares and may have extra cash and appetite to buy more. You may buy individual company shares or the shares of a group of companies, which reduces your risk.

It is advisable to identify and talk to a broker for specific advice and execution in this regard. It would help to think about which business shares you are interested in and not just be guided by how much the price has fallen in the past few days or months.

Also consider how many shares you wish to buy or how much money you are willing to spend before starting your conversation with a broker.

You can also invest in tax-free shares. It is also important to avoid shares of companies that have too much debt, and when looking at share price movement at least look at a 12-month movement.

There are many considerations, such as what is in your current investment portfolio and its risk profile, business fundamentals, the price/earnings ratio, and other factors that your broker may consider.

There are many ways of obtaining information on investing. One of them is to Google: “How to buy shares in the JSE.”

The JSE website gives you step-by-step guidance on how to buy shares on the JSE. Whether you are investing locally or offshore, it is a good idea to have a long-term view in mind.

If you have the appetite and the cash to invest in shares, the significantly reduced prices may suggest that this is good timing, but make sure that you get expert advice.

6. Government protection from inflated prices

Government has listened to the cry of the people who were exploited by those who increased the prices of goods and services in the name of demand and supply. Warnings and charges have been issued against companies that increased prices, thereby giving consumers protection from runaway prices.

It is because of the Covid-19 pandemic that it became easier for government to intervene and curb this inflation.

7. Encouraging risk budgeting

Covid-19 has reminded us of the risks we face on a day-to-day basis in all spheres of our lives, particularly where our finances are concerned.

This should remind you to have a way of prioritising that propels you to think of that which you want to protect or those events that you need to deal with either by preventing, reducing or eliminating their financial impact on you in the event that they happen.

This approach means that you set objectives and allocate sufficient money or resources to dealing with potential events, such as living healthy to prevent health deterioration, investing in a medical aid to manage health challenges should they arise, and buying life or death cover and funeral benefits should the worst happen.

An easier way is to think of it as: “What is the cost of not doing it?”

Covid-19 is an important, positive reminder that we need to think about and provide for those things that require our attention, as well as their impact on us and on our finances.

The cost of not getting medical attention when you need it can be dire and the cost of an unsecured loan can also be extremely high.

8. Creative space and time

A lot has been said about possible family benefits and home maintenance. Most of us, if not all, can think of mental and physical activities that can benefit us, the society and the economy during this period.

Some ideas may initially fail or be deferred, but may pay off later. The point is that we have the time, a resource which we can use in amazing and creative ways that can produce solutions to big problems if we put our minds to it.

These creative plans and activities that we produce in this period may end up as long-term businesses, or health and social assets.

Focus on the idea, quantify its key aspects as much as you can, and identify qualitative benefits in a concise way so that they can be assessed against your smart objectives at the right time. But make sure that the planning is followed by execution.

The three weeks that we have, which for some is a fully paid leave, reminds me of my days as a Fedsure Holdings executive, where we would be given a thinking day once a week. If used appropriately, this extended period can be used for thinking, evaluating, testing and implementation, depending on the scale and scope of your idea.

Chauke is CEO of Mathaveiya Skills Enhancement

Publications

Publications

Partners

Partners