The oil price this year may drop to as low as $10 per barrel, but a weak rand and a host of fuel levies means that fall will bring little relief to South African motorists.

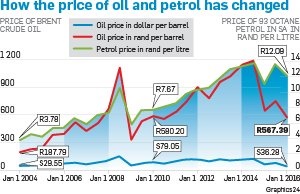

The price of Brent crude dropped by almost 5% per barrel in the first two weeks of 2016 and stood at $29.54 on Friday night. The last time oil was so cheap was in February 2004 – but unfortunately it does not mean motorists will pay the same price for fuel as in 2004.

The price of 97 octane in February 2004 on the coast was R4.02. Today, 95 octane on the coast costs R11.94.

Not only has the price of the dollar weakened from R6.61 to R16.40 in this time frame, but other costs in the calculation of the petrol price have risen sharply.

The petrol levy has risen from R1.01 to R2.55 per litre. The road accident levy rose from R0.21 to R1.54 per litre and the retail profit margin rose from R0.35 to R1.61.

When the oil price traded at nearly $140 per barrel in 2008, nobody predicted it would tumble by nearly 70% from January 2014, when the price was above $100 per barrel.

Suddenly, analysts are no longer laughing at American investment bank Goldman Sachs’ prediction last year that the oil price would drop to $20 per barrel.

British banking group Barclays now expects an average price of only $37 per barrel in 2016, and most analysts have adjusted their predictions of the price from $40 and $50 a barrel to between $30 and $40 per barrel.

Paul Horsnell, head of commodity research at Standard Chartered, believes the oil price could even drop to $10 per barrel because the price is currently a function of uncertainty in the global financial market.

“The oil price fluctuates primarily due to movements in other asset classes such as the US dollar and equity markets,” said Horsnell.

The price of lead-free 93 octane in Gauteng could drop to R9.55 if the oil price drops to $10 per barrel.

“The consensus has suddenly changed and the feeling now is that there’s a lot more oil than people know what to do with,” said the commodities division of Rand Merchant Bank (RMB). It says analysts expect that the lower oil price will force American shale gas producers out of the market, but American production hasn’t decreased enough to remove the overabundance of oil on the global market.

Market glut

In fact, US oil supplies remain at 100 million barrels (or 159 000 million litres) above the five-year average, reports Bloomberg.

“It’s not clear how America’s oil supplies will change and it is not clear how much oil China is able to store,” said RMB.

Although geopolitical tension in the Middle East usually leads to higher oil prices, this is not the case at the moment.

“The battle between Saudi Arabia and Iran will not be one with tanks and guns, but also with oil.”

Sanctions against Iran’s oil exports are expected to be lifted after the country sealed an agreement with the US to close its nuclear power programme.

Iran’s oil minister has repeatedly said at meetings of oil producers’ cartel Opec that other Opec countries should make way for Iran’s oil production when it is allowed to export again.

According to RMB, that seems unlikely after Saudi Arabia broke diplomatic relations with Iran.

This followed after protesters attacked Saudi Arabia’s embassy in Iran in response to the execution of the prominent Shiite cleric Sheikh Nimr al-Nimr.

“Saudi Arabia and other Opec countries that are their partners will not make space for Iran, because in addition to their political agendas, they must also balance budgets, and they do not want to give up their market share.”

This means that when Iran begins exporting oil again to the tune of 1.5 million barrels a day – the level it produced before the sanctions – it will flood the market and worsen the current oversupply of oil.

“Saudi Arabia can operate their current oil rigs at prices as low as $7 per barrel without having to make an operating loss. US shale gas producers can only operate at up to $20 a barrel and, therefore, many people expect that oil prices will only drop to $20 per barrel before they start rising again,” he said.

Publications

Publications

Partners

Partners