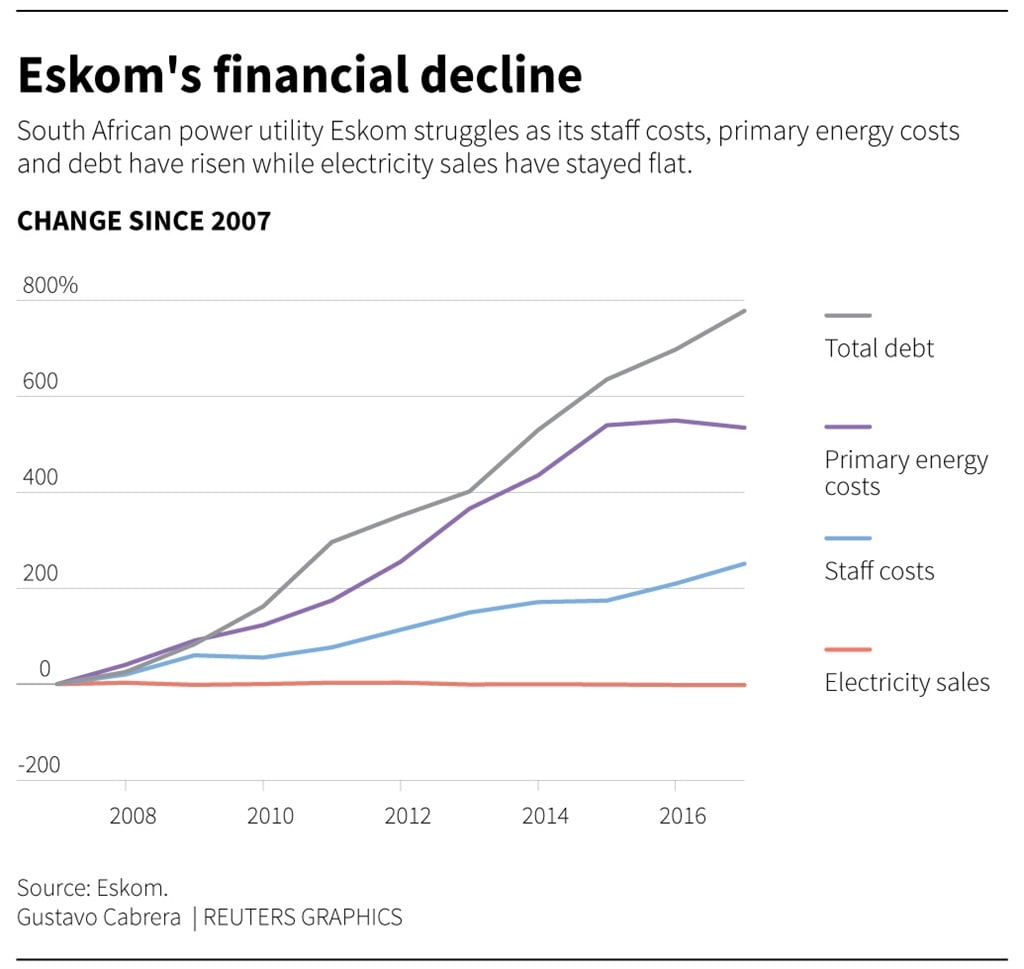

The rand stretched losses early on Tuesday, with sentiment dampened after state power firm Eskom reported a R2.3 billion loss, with emerging market investors looking elsewhere for returns.

Read: ‘The damage was not done overnight so can’t be fixed overnight’: Eskom

At 8.30 GMT the rand was 0.26% weaker at 13.4950 per dollar.

After a brief rally at the end of the previous week the currency is back on the ropes, pressured by the patchy domestic growth outlook and ongoing uncertainty about global trade, which has seen investors seek out safety in developed markets.

On Monday Eskom, which supplies more than 90% of the country’s power and survives on R270 billion of state-guaranteed debt, released financial results showing it still remains a major threat to any economic turnaround.

The state-owned power producer revealed these findings at its group integrated financial results presentation for the year ended March 2018 on Monday.

Eskom, Africa’s largest public utility, was embroiled in corruption scandals under former president Jacob Zuma and narrowly avoided a liquidity crunch early this year after banks halted lending. Zuma has denied wrongdoing.

Cash-strapped Eskom has also become one of the most visible examples of the effects of corruption at state-run companies in South Africa, as a pay dispute with unions triggered protests leading to a spate of rolling blackouts last month.

President Cyril Ramaphosa replaced Eskom’s entire board and top executives in January, in one of his first interventions since becoming leader of the ANC.

“Eskom is undoubtedly facing one of the most difficult times in its history,” Eskom chairperson Jabu Mabuza told reporters.

“We are not able to tell you today that all the skeletons are out.”

Eskom blamed the R2.3 billion loss for the financial year which ended in March on increases in financing costs and depreciation of assets like Kusile and Medupi, two massive coal-fired power stations which have suffered significant delays and cost overruns.

It also reported R19.6 billion of irregular expenditure and said it had R15.8 billion of cash at the end of March, down from R20.4 billion a year earlier.

Eskom’s new management is combing its finances from late 2012 in an effort to recover money lost through corruption. It has asked for criminal cases to be opened against some former employees and suppliers.

Chief executive Phakamani Hadebe said Eskom had started discussions with the government about getting its staff numbers right, a veiled reference that the firm is considering cuts to its bloated 47 000 workforce.

Analysts have long called for Eskom to take action to reduce ballooning staff costs, and Mabuza said on Monday the company believed it had around one-third too many employees.

Eskom executives also said they were looking at whether to sell non-core assets to shore up the firm’s balance sheet.

ANC sources told Reuters this month that Ramaphosa had secured the backing of senior figures in the ruling party for steps to boost private investment in the power supply industry, including by selling off non-essential parts of Eskom’s business.

Eskom has already announced plans to sell a mortgage lender it owns.

“We are busy with the process of optimising our balance sheet,” chief financial officer Calib Cassim said, warning that high financing costs would continue to drag on Eskom’s bottom line in the 2018/19 financial year.

Cassim added: “We are leaving all our options open.”

While the rand managed to hold below the 13.50 mark, a recent sell target for investors weary of the currency's volatile swings, traders said it was likely breach the mark this week.

Bonds were also weaker, with the yield on the benchmark paper due in 2026 up 1 basis point to 8.785%. – Reuters

Publications

Publications

Partners

Partners