Prioritising tax morality and administration, Sars boss puts structural measures in place, including AI, to ensure efficient collection

The taxman will focus on better tax compliance and a stronger administration in order to collect revenue over the next three years, after taxation rates were this week left largely unadjusted.

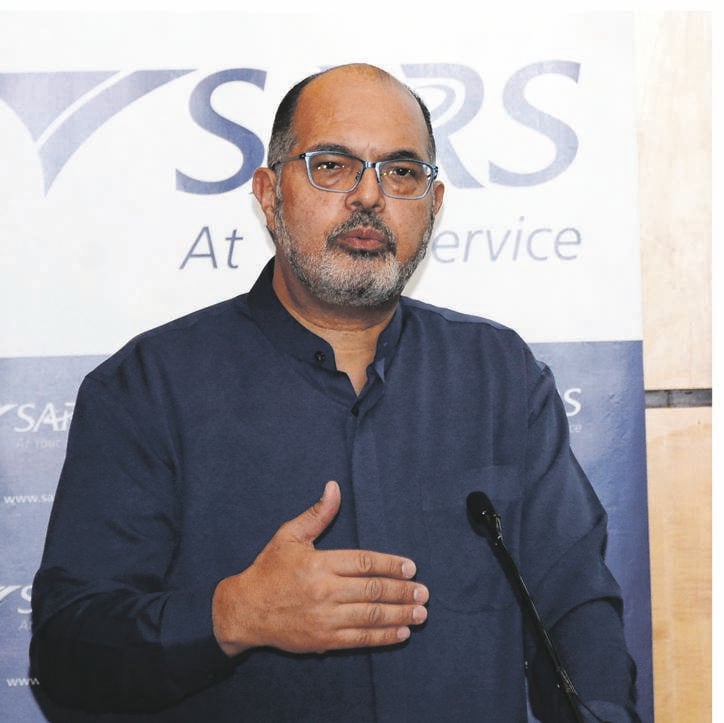

This is according to SA Revenue Service (Sars) commissioner Edward Kieswetter.

He was speaking at a PwC panel discussion reviewing Wednesday’s budget.

“When revenue comes under pressure, the temptation is always to increase taxation rates, because that is the easiest way to address the problem,” said Kieswetter.

“From our side, we realised that increasing the tax rates now would negatively affect the economy and would not increase tax revenue. South Africans are under pressure.”

This comes after Finance Minister Tito Mboweni did not announce an increase in income taxes or VAT during his budget speech this week, contrary to expectations.

Although Sars will collect an estimated R63 billion in taxes less than its target, Mboweni said government realised that there was no room to tax South Africans any further.

Sars is an integral part of a well-functioning state, which is why there will be a focus on restoring its institutional integrity and on the fight against criminal activity, said Mboweni.

According to Kieswetter, tax morality (levels of compliance) and the capacity of the administration are two important components of effective tax collection, but both have regressed over the past few years as a result of state capture.

These are now being rebuilt.

He said the compliance model that Sars follows rests on taxpayers knowing exactly what their tax obligations are, making it easy for them to comply, and on credible measures to police tax evasion and noncompliance.

“We were applying this system the wrong way around. We were punishing those who comply with their tax obligations and letting the criminals get away,” said Kieswetter.

“We cannot have a tax environment where an elderly lady who just wants to submit her tax return has to stand in a queue and wait for six hours.”

ORGANISATIONAL STRUCTURE

Kieswetter said that since his appointment in May last year, he had been working hard at getting the right organisational structure in place at Sars.

“It takes long, because you have to understand the extent of the decline inside tax administration. The situation is way worse than the Nugent report makes it look. The decay makes you want to cry.”

Much of this took place when Tom Moyane was the Sars commissioner.

He was fired on the recommendations of the Nugent commission of inquiry into tax administration and governance at Sars.

Kieswetter said that since 2013, Sars had lost about 3 000 employees – almost half of whom were people with technical knowledge and skills.

Among these losses are 250 auditors, more than 100 specialists in transfer pricing and other technical fields employed in Sars’ large business centre, as well as 200 debt collectors.

He said Sars was now beginning to use data better in order to make up for some of these losses.

For example, a simple artificial intelligence (AI) model is being used to determine how many people own more than one property but have not declared it, so as to hide rental income.

As a result, an additional R500 million in taxation has already been collected this year.

In its fight against the abuse of VAT repayments, Sars has targeted 600 entities.

Kieswetter said these entities register shelf companies for VAT, without the intention of actually doing business.

Thieves then purchase some of these companies and claim VAT inputs for three or four months, prior to the start of trading.

But they never actually intend to do any business and shut the companies down after four months.

COMPLIANCE

Over the past few months, R600 million in VAT abuse has been prevented using this methodology.

Compliance among employers who subtract monthly tax deductions from their employees’ salaries to be paid over to Sars (pay as you earn, or PAYE) is at just 57%.

Kieswetter said that according to legislation, employers are agents of Sars who collect taxes on behalf of the revenue collector.

But scores of employers do not pay the money over to Sars, using it for other purposes instead.

Sars is then forced to knock on the doors of the individual taxpayers.

He said that in five years’ time, Sars wants to be at the point where an ordinary taxpayer, who has a single employer and whose deductions are done through the payment system, will no longer have to submit a tax return because Sars will have everything on record and will be able to process their taxes quickly and efficiently.

He said the ultra-rich and large businesses present the biggest opportunities for revenue collectors to collect income.

In particular, Sars is looking to individuals with a high net worth to get their tax affairs in order.

“Through international cooperation, we see all the money that is flowing overseas. We know that there are 2.1 million South Africans with overseas assets.”

He said Sars has been doing the easy work over the past seven years, not necessarily the important work.

For example, a Sars official told Kieswetter last week that he wanted to focus on PAYE audits, but that the key performance indicators in his employment contract required him to do 1 million personal income tax audits.

Publications

Publications

Partners

Partners