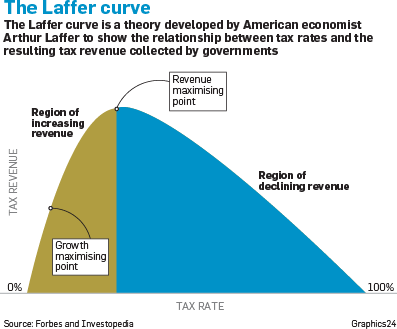

US economist Arthur Laffer, the man behind the famous Laffer curve – which suggests that there is a point where tax increases become counterproductive and yield less income for the state – wants to visit South Africa to share his ideas with policymakers.

Azar Jammine, chief economist and director of Econometrix, said a mutual acquaintance approached him a few weeks ago to discuss the possibility of inviting Laffer to South Africa to engage with authorities.

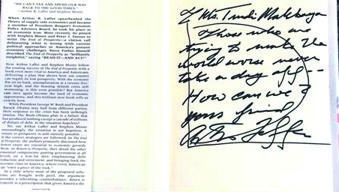

Laffer, who served as an economic adviser to US presidents Ronald Reagan and Donald Trump, sent two signed copies of his book Return to Prosperity to Jammine.

One was specifically addressed to Trudi Makhaya, President Cyril Ramaphosa’s economic adviser. Jammine said he wrote a letter to Makhaya’s office to tell her about the book.

Makhaya’s office confirmed receipt and that is where matters now stand.

Laffer, whose theories on tax increases had a big impact on American economic policy in the 1980s, developed an interest in South Africa because experts had for some time been warning that South African taxpayers were close to or already past the top point of the Laffer curve.

This means that, even if personal income is increased, the amount of money flowing into state coffers decreases because the higher taxes discourage people from earning money and declaring their taxable income.

Tertius Troost, a senior tax consultant for Mazars, believes that South Africa has already reached the turning point of the curve when it comes to personal income tax.

“The 2017 budget figures show that fewer than 110 000 taxpayers were responsible for 26.6% of the total income tax collected from individuals. If you look deeper, it appears that more than 1 million people are responsible for the two-thirds of tax collected from individuals,” Troost said.

He said that the SA Revenue Service (Sars) has missed its collection targets for a couple of years in a row and it looks as if Treasury has now accepted that we’ve reached the top point of the curve.

In his medium-term budget speech in October, Finance Minister Tito Mboweni said that income projections took into account that there would be no tax rate increases announced in the national budget speech next month.

Mazars, therefore, does not expect any changes to tax rates.

Kyle Mandy, head of tax policy at PwC SA, said that, given Sars’ weakness in collecting revenue over the past two years, it would appear that South Africa has passed the top point of the curve in the current sociopolitical environment.

“Despite significant tax increases in 2016/17 and 2017/18, the relationship between tax and GDP has weakened when compared with what it was in 2015/16,” Mandy said.

Tax experts from Deloitte agree that there is very little room for tax increases this year.

Tax revenue buoyancy – the ratio of tax revenue growth to nominal GDP growth – has been declining over the past few years, and it is not expected to increase as quickly as previously thought, with the 2017/18 tax revenue buoyancy below the long-run average.

But the Laffer curve should not be seen in isolation. The poor economy, along with taxpayers’ perceptions that government spends money ineffectively, probably plays an important role in South Africa’s movement on the curve, said Hannah Edinger, Deloitte associate director: Africa Insights.

Troost said it was more complicated when it came to corporate tax rates.

He believes South Africa’s corporate income tax rates are on the upper end of the scale when compared with other countries worldwide.

To ensure that we stay competitive, the rate should not be increased – something the Davis Tax Committee also recommended.

Higher company taxes can mean more income for the state over the short term because it takes a while for companies to pack up and leave the country when they feel they are being taxed too heavily.

In the long term, however, it could lead to a decrease in tax income because companies will leave for destinations with more favourable tax dispensations, said Troost.

He believes it is much wiser to lower the tax rate for companies to attract additional investment and stimulate economic growth.

This will eventually ensure greater tax income.

“Unfortunately, that’s a very long-term view, which is difficult in our present political climate. Treasury will also most likely have difficulty implementing it because unions would prefer to see VAT being lowered back to 14%,” said Troost.

Mandy said government could improve its financial situation if Sars strengthened its capacity and improved revenue collection, and if wasteful government expenditure, corruption and ineffective spending were effectively addressed as this would strengthen tax morality and lead to better compliance.

Rather than increasing tax rates, Deloitte said, the country’s tax base should be enlarged to collect more tax.

Publications

Publications

Partners

Partners