‘Accounting irregularities” is the euphemism used to whitewash corporate malfeasance and fraud.

The news of the fraud perpetrated at both Steinhoff and Tongaat Hulett started with announcements that irregularities had been discovered.

It has since been established that both companies were the victims of systemic and long-running fraud by senior management.

At Steinhoff, CEO Markus Jooste and his friends engaged in transactions aimed at enriching themselves while defrauding the company and its shareholders.

To do so, they used a global web of companies, including notorious tax havens such as the British Virgin Islands.

READ: Some aspects of Steinhoff fraud case ready for trial - Hawks

A forensic investigation by PwC revealed that for at least a decade, “a small group of Steinhoff Group former executives and other non-Steinhoff executives, led by a senior management executive, structured and implemented … fictitious and/or irregular transactions” to misrepresent profit by more than R100 billion.

The alleged fraud ranged from misstating the value of assets [and] incorrectly listing expenses as assets [to] declaring income from the sale of land that had not yet been sold and then failing to declare it when some of those deals fell through.

In December 2019, Tongaat confirmed that the “undesirable” practices led to the 2018 financial statement inaccuracies to the tune of nearly R12 billion and that the company’s assets were overstated by R10 billion.

In both cases, there was a catastrophic failure of corporate governance, but the public harm was also significant. In South Africa, 948 pension funds were invested in or exposed to Steinhoff.

Rather, the NPA and the Hawks seem to be relying on Steinhoff and the private sector to finance its investigation – in 2021, accepting R30 million from Steinhoff to be paid to PwC, which conducted the forensic investigation into this matter.

But, just where were the auditors?

See no evil, report no evil

Aside from being sites of looting and fraud, Steinhoff and Tongaat Hulett have something else in common. Their auditor was Deloitte.

Steinhoff has been described by at least one director as “in effect just a giant Ponzi scheme”. So, how did Deloitte’s auditors not spot what was going on?

Deloitte was the company’s external auditor from the time the company listed in 1998.

Every year for 20 years, Deloitte stated that Steinhoff’s financial statements “fairly present, in all material respects, the financial position of the company”.

READ: Jooste must declare more assets

Until 2017, they were apparently oblivious to the billion-rand hole in the company’s finances. When they finally did refuse to approve the statements in November 2017, it was too late.

In 2018, Deloitte accepted the need for an investigation by the Independent Regulatory Board for Auditors (IRBA) but said that they remained “confident in their conduct” at Steinhoff.

Deloitte defends itself on the basis that they flagged concerns about the 2017 accounts. Yet, this was only after a criminal investigation related to possible fraud had commenced in Germany.

In their view, the public is expecting too much. This is the so-called expectations gap. This argument is dangerous because it contains truth and yet is disingenuous in this context.

External auditors are not tasked with looking for fraud. However, the profession is based on a duty to show “professional scepticism” – defined broadly as “an attitude that includes a questioning mind, being alert to conditions which may indicate possible misstatement due to error or fraud, and a critical assessment of audit evidence”.

If an auditor’s professional scepticism leads them to identify any misstatement, fraud or other crime, they are legally bound to report it. Moreover, if an auditor is uncritically approving what management says, it is hard to see what value they deliver at all.

It is not enough for Deloitte to say that finding fraud was not its job. The public is right to demand answers as to whether its auditors used a questioning mind, were alert to conditions indicating possible misstatement, and critically examined evidence they were provided with.

READ: As the Hawks made arrests we had to ask: What about Steinhoff?

It is difficult to believe that Deloitte did all of these things and yet failed to identify any of the widespread fraud and misstatement at both Steinhoff and Tongaat. Deloitte was Steinhoff’s auditor for two decades. It was Tongaat’s auditor for more than 15 years as well. This kind of entrenched relationship inherently undermines the independence that an auditor is supposed to exercise.

Deloitte’s long-running work for these firms means they should have had an even greater insight into the company and how it operated. The only upside to this is that it should have made it easier to identify patterns of strange transactions in both cases. This did not happen.

Will there be accountability?

There are serious questions about the quality of Deloitte’s work at Steinhoff and Tongaat. However, we cannot say with certainty precisely what the auditors knew, and for how long. Both Steinhoff and Tongaat have refused to release the full forensic reports (both compiled by PwC at incredible cost) that expose the extent of the rot.

In 2022, Steinhoff was ordered by the Western Cape high court to release the full 7 000-page report to the Financial Mail and amaBhungane, which had applied to the court following Steinhoff’s refusal to comply with a Promotion of Access to Information Act request. Steinhoff is seeking to appeal this judgment.

In the absence of this information, the public relies on the IRBA to investigate and hold the firms to account. But the reality has been disappointing.

While Treasury and the IRBA are in the process of increasing the regulator’s powers of investigation and sanction, the IRBA still faces incredibly well-resourced firms who throw money at the best legal teams to fight their cases.

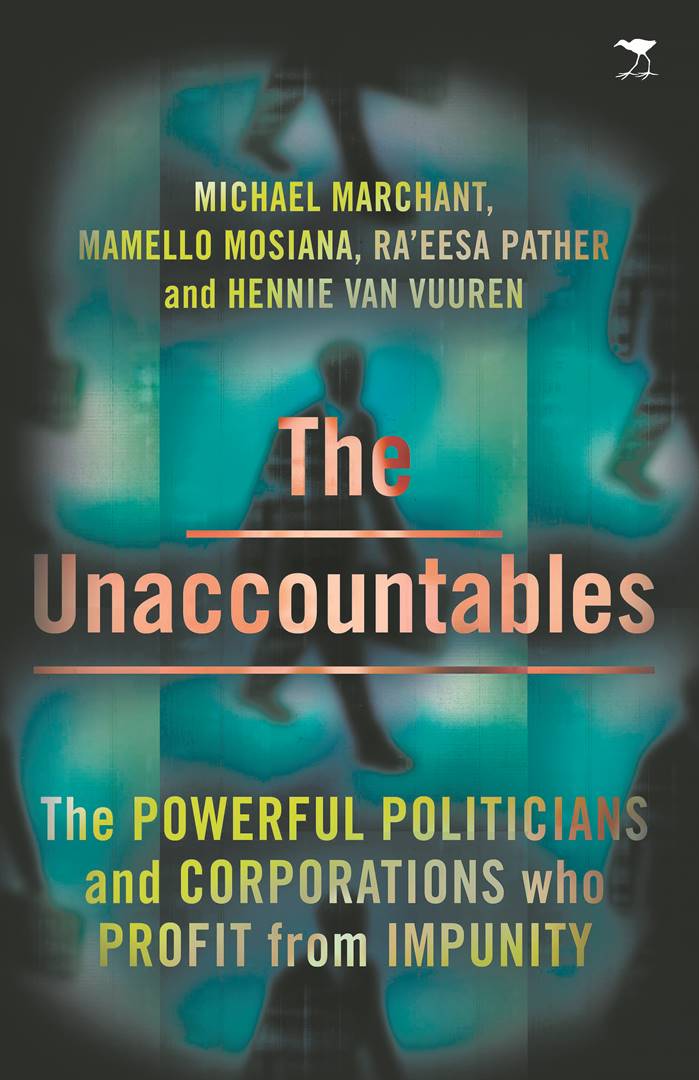

The recommended retail price of The Unaccountables is R280

Publications

Publications

Partners

Partners