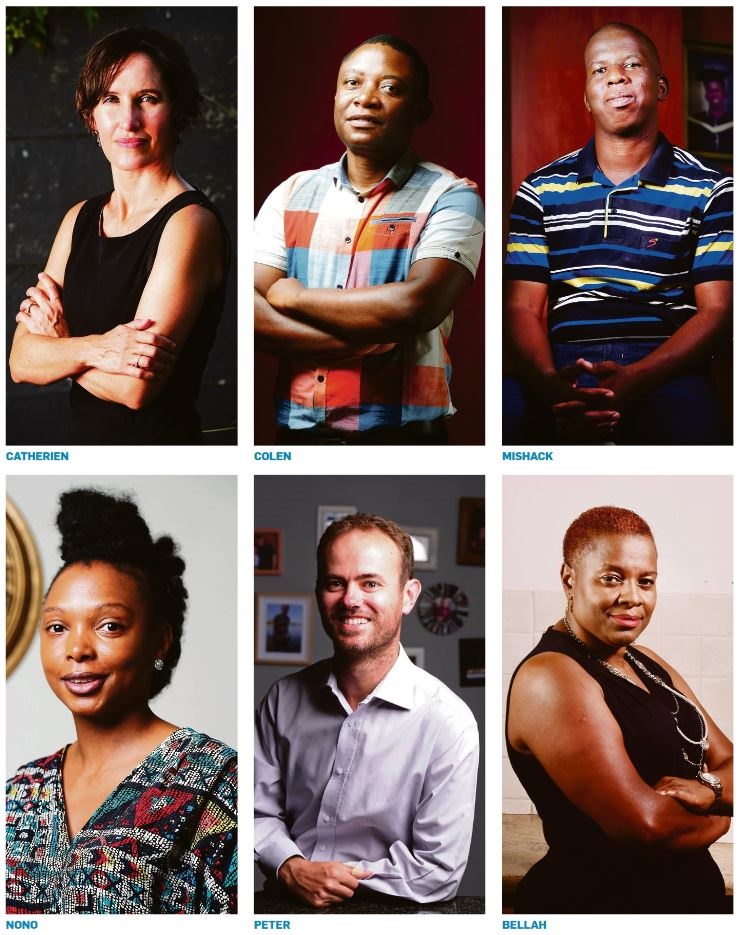

The real motivation behind financial freedom is to live our dreams; it just requires a plan to get us there. While our contestants have focused on shorter-term goals over the past six months, their journey has just begun as they share their plans for those bigger dreams.

In this piece Maya Fisher-French looks at some of the lessons the Absa/City Press Money Makeover candidates learnt over the past six months.

For more on personal finance lessons and tips click here.

RENOVATE: WITHOUT DEBT

“Our big dream, of course, is that our son will be 100% healthy. While managing our money better won’t necessarily make our son better, the great thing is that our financial stress is now something that we have put behind us. There is less stress in our home, which also adds to possible healing,” says Catherien.

At the beginning of the year, the family bought their first home, a real fixer-upper. The big dream is to renovate the house by the end of the year with cash.

READ: Important lessons learnt during a six-month money makeover campaign

“No loans and no debt! We are making a priority list, getting quotes for what we cannot do ourselves and saving up until we can do it. In the past, we would have just gone into debt by using credit, but now we just will not go that route.”

CATTLE RANCHER: CREATE A STRATEGY

Colen’s long-term dream is to own a cattle farm. His Absa financial adviser JP van der Merwe says that, to realise this dream, Colen needs to plan carefully, save and make sure he does his homework so that the dream does not become a nightmare.

“Operational costs will be incurred for a long period of time before any income is generated,” says Van der Merwe, who recommends that Colen start by acquiring some cattle and grazing them on another farmer’s land.

READ: Lessons in planning a successful property portfolio

“This method may make it more affordable to start a farming operation until it is feasible to expand into a sole operation,” says Van der Merwe, adding that it is important to quantify the amount that Colen wants to save for this dream.

“We need to calculate what he must invest over the next 10 years, and make sure we invest so it can grow ahead of inflation.”

GOING BACK TO SCHOOL: PLAN FOR ALL COSTS

“Studying will increase my chances of getting a promotion and subsequently alleviate the financial pressures,” says Mishack about his big dream.

Though his employer will subsidise his studies, he would have to pay the money back if he fails or resigns.

“I need to plan around it, so my adviser Johan Frouws recommended I put money aside for those extra studying expenses, such as registration and examination fees,” says Mishack.

READ: Owning a home can be more pricey than you think. Here are the ‘hidden’ costs

If you are planning to study, make sure you allow for supplementary costs, such as books. If you do not plan for those, they end up on the credit card.

“Should the first dream go according to plan, my next plan is to save for a white wedding celebration for my wife. For now, that is on hold; the plan is to get the studying under way.”

FOCUS ON FUTURE GENERATIONS: INCOME-GENERATING INVESTMENTS

“The vision is for us to have more properties so that the generations after us have options we didn’t have,” says Nono, who also plans to grow her Salt and Light beauty product line.

Now that Nono has paid off her credit card, and her car will be paid off by December, the couple will add extra to the apartment from next year, while saving an additional amount for a deposit for a new apartment. The couple is aware that they will need to hire someone to help grow the beauty business, especially with a baby on the way.

READ: Create extra income with a side gig

“We have started developing an online shop to improve productivity and make our products easily available. We will appoint someone in August to help oversee the day-to-day running of the business, which will free me to concentrate on other aspects of the business, such as marketing.”

MY OWN BUSINESS: USE THE TIME NOW TO PLAN

“I still have a dream of setting up my own business, ideally in the IT services space, as that is what I know and where my skills are,” says Peter, whose dream is to have a skills-based training section that could ultimately provide employment.

“I will have to make use of my current network to get the first contracts. I still have contact with a few franchise retailers who I could approach, as well as some schools. I will have to wait and see what the fallout of the Covid-19 pandemic is, as budgets will more than likely be cut. This will also give me time to grow my emergency fund.”

READ: How to avoid the slippery slope of credit dependency

As an interim measure, Peter is going through the process of registering a business with the Companies and Intellectual Property Commission.

CREATING A LEGACY: INVOLVE THE FAMILY

Bellah wants to build her business and give her son a role to create a true family business. She has already started to diversify customers and increase her footprint, and her son is learning the ropes and will soon be able to help his mum grow the construction business.

Once her business is stable, her next dream is to start a skills development centre to teach and uplift primary school children.

READ: Turning a business cash flow positive

“Most of them just walk around after school doing nothing, and become vulnerable to predators. I want to help them start their own businesses, prepare them for after Grade 12, and teach topics to prevent gender-based violence,” says Bellah.

Know what you need: Any dream requires research, not only for financial goals, but for other building blocks you may need to put in place.

Break it down: If there is a lump sum you need, work out how long you must save for and how much to put away each month. As a simple exercise, take the amount you need and divide either by the amount you can afford to save or the number of months. If you need R50 000 but can only save R2 000 a month, R50 000/R2 000 = 25 months. Or, you know you need R50 000 in two years’ time: R50 000/24 months = R2 083.

Choose the right investment: While cash may work for shorter-term goals, if you are looking at a term of 10 years, you need a market-related growth investment to try to out- perform inflation.

Regularly review your goal and progress: Keep track, top up and keep dreaming.

“Never give up on a dream just because of the time it will take to accomplish it. The time will pass anyway.” – Earl Nightingale

| ||||||||||||||||||||||||||||||

|

Publications

Publications

Partners

Partners