Most households in South Africa are not financially secure.

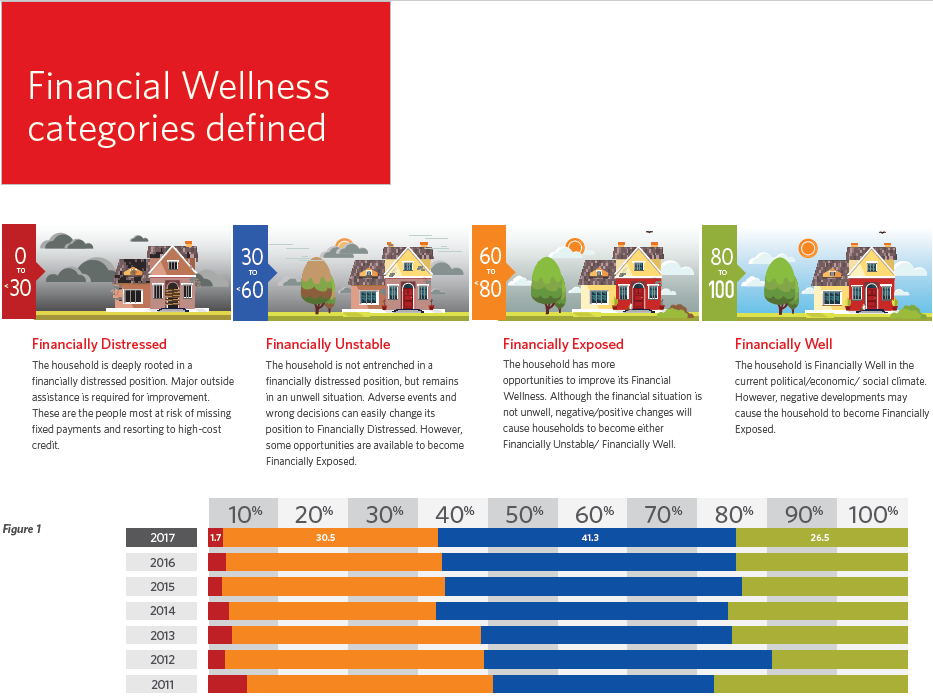

This is according to the 2017 Household Financial Wellness Index by Momentum and the University of South Africa (Unisa). The index reports that 73.5% of South Africans are not financially well.

It shows that the proportion of financially well households remained somewhat unchanged since the first study was done in 2011, but the major change was the movement from “financially unstable” to “financially exposed”.

“Although we have an improvement in better education it’s not translating to a better life and more income for the youth, for the people in households separately. That for me is one of the big concerning issues, we are educating [young people] with not necessarily the right skills and people don’t feel empowered,” said Bernadene de Clercq, associate professor at Unisa.

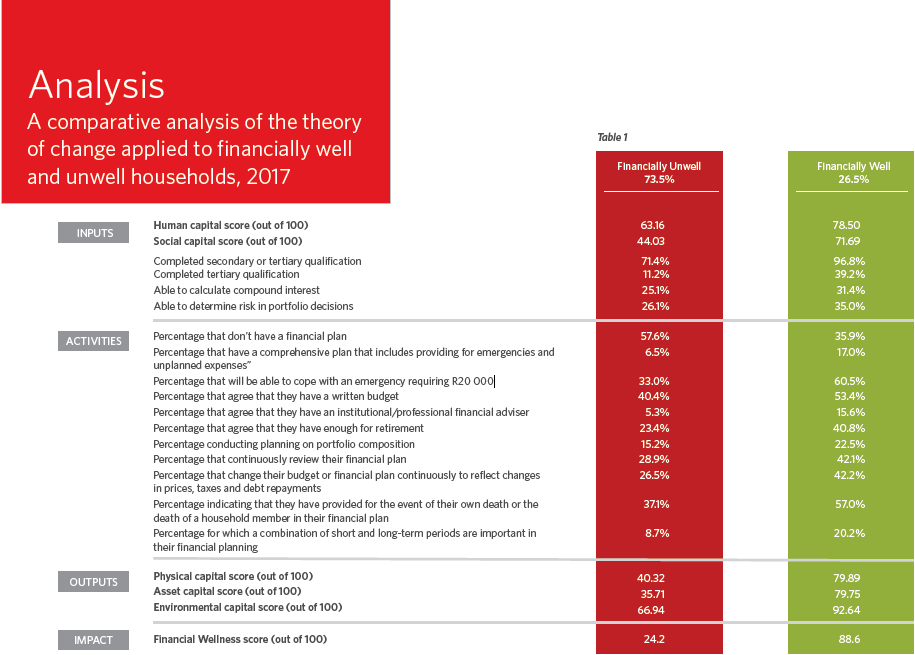

The report also showed that the level of financial literacy was considerably low for households in both financially unwell and financially well households.

“The other big problem is that people are almost over confident with their ability and with their provision and the reality check for them is such a huge rude awakening waiting for them and how can we cross that bridge for people to really become part of this journey,” said De Clercq.

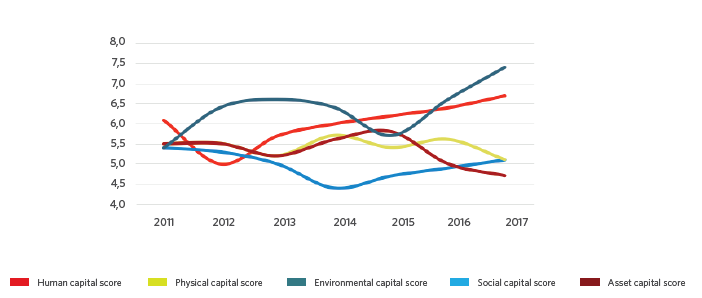

The report showed that the human capital (the state of the household’s education status determined by their qualification and skill levels) showed a slight constant increase since after 2012 – while the gap has remained the same between this and the social capital (the household’s belief that they can do something to improve their living situation).

De Clercq said the slight incline of human capital was due to the increase of people enrolled in high schools and tertiary institutions but said this had neither improved household income or feelings of empowerment.

“Although people are getting educated, the level of education is increasing, people don’t translate that to empowerment, they do not feel empowered, their social capital is not translating, she said.

The other household categories fluctuated over the years.

“The youth think their biggest assets are themselves, ‘I’ll keep on working until I’m dead so I don’t need retirement’. They work for three years then they stop working, spend all that they’ve got and then three years later they start working again,” said De Clercq.

The report showed that 40.8% thought they were financially on track to achieve their long-term financial goals, like retirement, and 23.4% thought that they were not on track.

“[This is probably the most alarming] of this entire piece of research because the reality tells us that the 40% who think that they are okay are actually mistaken. So that goes back to your own perception of what it will take for you to be financially well at retirement or how much you will need to retire on,” said Jeanette Marais, the chief executive of Momentum Investments.

Marais said this was a problem because less than 10% of people were actually able to retire financially well.

She said financial wellness depended on the ability to have sufficient savings, sufficient insurance and how much debt one had.

De Clercq said: “What we always try to advocate for is the principle of pay yourself first, so when you earn R100 then you immediately save R10 and then you start thinking of ‘I have R90 to spend’. But what most [people do] they spend R100 and think ‘oh I’ve got nothing left to save’ and I think that’s the mental attitude we’d like to change.”

She said people should start saving even if it’s a small amount and increase their saving as their income increases.

“The challenge for the industry is that people don’t stay in a job for 20 years anymore, they stay there three years and decide I don’t like this job. The problem is then they cash out any saving that they made, take off another year and then they start working again so the whole trick of compound interest is lost and then suddenly they might fall ill or we also have a big problem of parents becoming dependent on children and the other way around. So where’s the money coming from?” said De Clercq.

De Clercq said the youth had to understand the need to be responsible with a certain portion of their income and then live life with the rest.

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners