City Press reader Martha* is concerned that her home loan is not reducing fast enough.

“I have been paying extra into my mortgage each month, but it’s still taking a long time to pay it off,” she wrote. She then asked if it would make sense to rather take out a personal loan over five years and use the money to settle her mortgage.

Her logic is that this would allow her to pay off her home loan faster, even though the interest rate on the personal loan is 19% versus 10.5% on the home loan.

Martha is not the only homeowner to get confused by how a home loan works. A few months ago, we wrote about why it takes so long to pay off your home loan, and explained the massive benefit of paying extra into your mortgage each month.

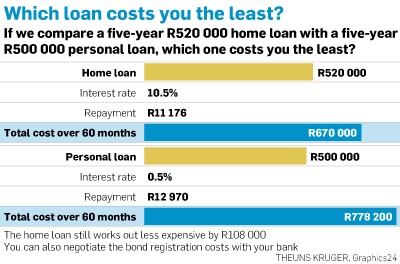

What Martha is unaware of is that she could pay off her home loan over five years without taking out a personal loan and that, by doing so, she would save more than R100 000.

Martha has her home loan with Nedbank, so we asked Thozama Mochadibane, the head of Nedbank home loans, to provide Martha with a solution.

Martha has an outstanding balance of R421 000. She has 179 months remaining on her home loan, which works out to 14.9 years. Her required instalment is R4 956 a month at an interest rate of 10.5%.

Read: The stubborn home loan debt

Martha is currently paying R6 500 a month into her mortgage. At this rate, she will have paid off her mortgage within 97 months (8.1 years). If Martha wanted to pay off her home loan within five years, she would need to increase her monthly instalments to R9 050.

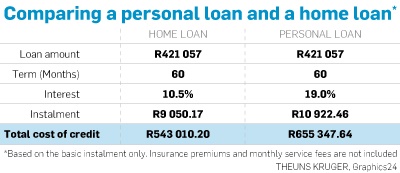

The first table is a comparison between a personal loan and a home loan based on the basic instalment only. Insurance premiums and the monthly service fees are not included.

Based on the figures, it is quite clear that Martha will pay higher instalments for the personal loan, as well as a higher total debt repayment.

If Martha opted for the personal loan, she would spend R112 337 more on interest. A home loan is the cheapest form of credit and the best way to finance a property. If you can afford to, you can pay off the home loan as quickly as you want to.

Read: The 20 year home loan fallacy

“We endorse the consumer’s action of paying more than her monthly instalment into her home loan account to reduce the term of her loan. Lump sum payments are even more advantageous to the term and the total amount to be paid by the consumer,” says Mochadibane, who adds that it seldom makes sense to use a personal loan to settle a home loan.

“While there may be circumstances where this may make economic sense – for example, when the balance outstanding on the bond is extremely low and the term remaining is shorter – even in such circumstances, it is advisable for clients to seek guidance from an accredited financial adviser who will help them make the right decision. It’s also important to note that every situation should be dealt with on its own merits based on the history of the account, conduct, payment patterns and, most importantly, the interest rate factors.”

*Not her real name

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners